A will is very common. In fact, it is safe to say that a will is the most common component of estate planning which is why most people believe that an estate plan is all about drafting a will. Consider the following when writing your Will.

Do you have minor kids?

No one wants to imagine dying young, especially those with little children. How do you cater for your kids? What will happen to them when you are gone?

If you have little children, it is best you are prepared for such scenario and the best way to get prepared is by planning your estate. You will have to set up a will to cater for the need of the children. You can name a guardian or a conservator a Last Will for your minor kids.

The size and complexity of your family

The truth is, the more the number of family you cater for, the more consideration for what you make your of your estate plan. If you have large family, you might should consider a more robust estate plan. Consider the following; If you are divorced, have children in past relationships, have a more than one spouse, you need to create a proper estate plan.

Location of assets

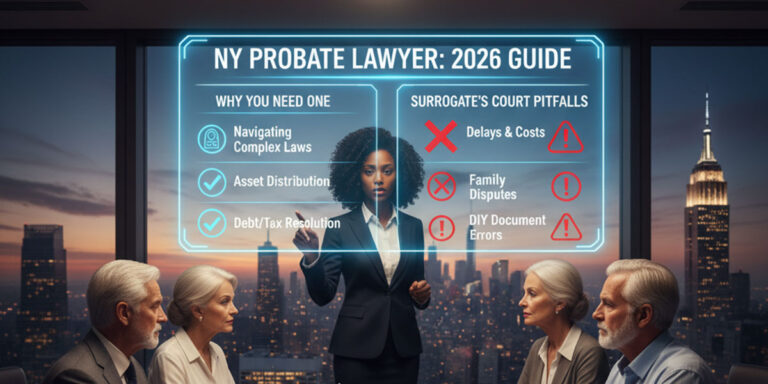

If you own assets in several states, then you need to consider creating a proper Last Will. Your Will should include all assets you own and where they are located. Typically, a primary probate proceeding is necessary to before the decedent’s assets can be shared. However, if your properties are not properly referenced in the Will, a secondary probate becomes necessary.

Consider proper Estate taxes evaluation

When estate value as mentioned in a document fails to match with your estate plan, a long harsh probate may not even save such asset. During implementation of estate, estate value are crosschecked, and tax allocations are considered very important. In case, you have a wrong value, the document will be declared invalid. You need an attorney to check and make proper evaluation of assets named in the estate documents. This could seem like an easy task, but a simple mistake could overturn all the document. Only rightfully accounted assets can be verified and implemented.

If you have created a Will, be assured that your wishes on how you would like to share your assets to beneficiaries will be implemented. Even while you are not alive, a surrogate court will still uphold this desire.

However, when you die without an estate document or a Will, then there’s no way a court will know what your desire are; as such your estate will be subjected to intestacy law in New York. The intestacy law uses a form of hierarchy to distribute deceased assets to surviving relatives. Usually, the surviving spouse get the estate first, then the deceased children, followed by parent. Next is the deceased siblings. Typically, all relatives not directly related to the decedent are completed left out of this process.

Estate plan sequence you should consider.

- Draft a Will

A will is a very important component of an estate plan. This legal document comprises of your wishes regarding your estate, including the name of the estate beneficiaries and executor of your estate.

To draft a will, you will require the help of an estate planning lawyer. You can contact us when ready and we will provide you with the best estate planning lawyer for your estate.

- Create a Trust

A trust is simply a legal vehicle used in the transfer of assets. The trust maker gives the trustee the right to hold the transferred assets for the benefit of a third party (beneficiary).

This legal document is key to creating an ideal estate plan. By creating a trust, you can save your loved ones the stress of passing through the difficult probate process. A trust lawyer or an estate planning lawyer can help you prepare this document.

- Create health care directives

A health care directive can protect you in the event that you aren’t able to make certain health decisions yourself. This document is an important component of estate planning, thus, when creating an estate plan it is crucial that you state your wishes for health care.

- Financial power of attorney

A financial power of attorney provides you with the opportunity to give a trusted person the right to oversee your finances and properties in the event that you become incapacitated. The person chosen is usually regarded as an agent or an attorney-in-fact. It is not necessary that you select an attorney as your attorney-in-fact. You can simply select someone who is genuine, familiar with your family, and trustworthy.