Why An Update

When it comes to already having an estate plan there can be events that can occur where you need to change up your entire plan. It can be small things that can cause big problems. For example, let’s say if your child has just turned into the legal age of being an adult. You can now add him or her to other and bigger plans on your estate plan. Other events can occur like; determining type of death, adding anymore dependents or beneficiaries, having a new child, you became married, divorced, someone that may have been disabled, and or any change of amount of assets gained.

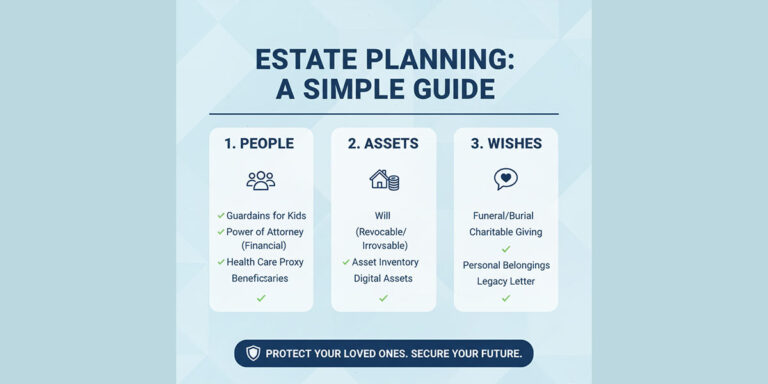

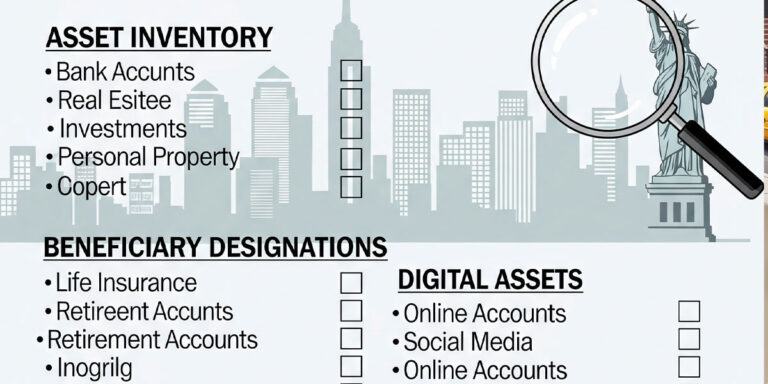

You can keep updating your plan anytime you want to with a slight extra fee. A lot of people like to keep track of their financial plan either every other month or even once a year. You can even change any beneficiaries or holder of the plan. Though the entire probate process can take up to a year as well so whatever changes that need to be made should be necessary. With this plan you can even assign a guardian and make sure any child is taken care of.

It’s important to talk about what your estate plan is and make sure you have a professional attorney to do so for professional input. Changes made should be significant and make sure every loved one is taken care of. If you need all sorts of advice we provide a service for the best estate plans in Syracuse NY.

FAQ

1. How Often Should I Update My Estate Plan?

Your estate plan should be looked over every 5 years or so but may need adjustments if you’re involved in marriage, bear any children or filed for divorce. This is due to legal laws within the state and now who’s involved.

2. What is a Revocable Living Trust?

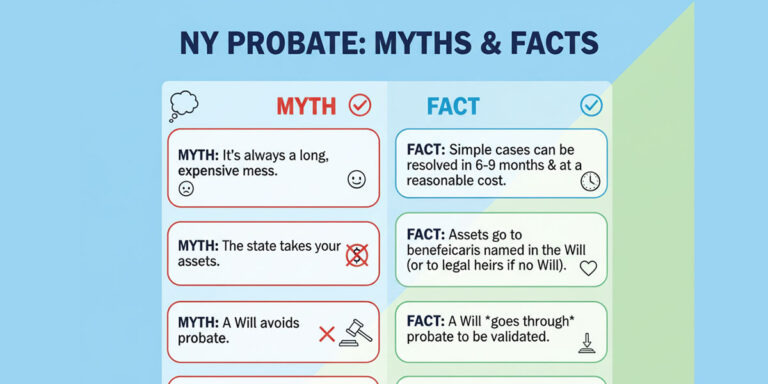

A revocable living trust is needed when it comes to managing your own assets and what to do with them if you’re in critical condition or aging. A living trust can give you the luxury of choosing what kind of healthcare proxy you want and also has the power to avoid the probate process that can save you from those fees.

3. What is an Estate Settlement?

An estate settlements is the process of a decedent’s estate being transferred to an assigned trustee or beneficiaries. There’s also planning of who obtains all these assets but expenses that go with it all.

4. Often Should I Update My Estate Plan?

Your estate plan should be looked over every 5 years or so but may need adjustments if you’re involved in marriage, bear any children or filed for divorce. This is due to legal laws within the state and now who’s involved.

5. What is the benefit of hiring an attorney if free forms are available online?

Once an attorney is hired you have a professional say towards your Estate and where it’s being distributed. Free aren’t very beneficial and reliable because you’re not getting as much service as you would from an actual attorney. There may be some fallacies and interferences on these forms. This can cause difficulties at any court process difficult, longer and expensive.

6. How can I leave my estate to my spouse tax free?

Once there’s a verified death the surviving spouse will be tax-free from the estate.

7. What is a Will Contest?

A Will contest occurs when the probate has been challenged. This can occur if the Wills isn’t clear or many things everyone in the family won’t agree with. More fees can occur but may be getting rid of the possibility of other fees if the Will is challenged. The attorney must supervise the entire process as well to make the document more valid.

8. Can an irrevocable trust be amended?

One thing you can do by is to remove assets you’ve written within the trust. You will still have the trust on file but it’ll be one that is empty. There’s also booking an appointment with the court through a trustee since he or she is responsible for making any adjustments as well in the trust even if it’s irrevocable. As long as there’s a good reason for the modification.

9. Can I collect unemployment if I go to school?

To receive unemployment you need to document that you’re looking for work and enrolled in school to receive some benefits.

10. How long do you have to work to collect unemployment in NY?

According to the official ny.gov website, you need to be working for at least a month and in file at least $2,700 in wages.Your base period also needs to be higher than your quarter wages.