Probate is a legal process with which the court uses to ascertain the validity of a will. There are various steps involved in the probate process. This process is initiated by the executor to the estate. The executor is a person that is named in the will by the testator; he is in charge of the distribution of the estate among the heir and beneficiaries of the testator.

The probate process does not necessarily come into play only when there is a will. When there is no will, the probate process is used to decide how the person’s estate is going to be distributed among his heirs.

Skipping probate

Most people often plan their estate in order to skip the process of probate. This could be for a number of reasons. A will that is not specifically designed and planned to skip the probate process will definitely go through the process of probate as this is the only legal way by which the deceased person’s assets can be passed down to his heirs. Without the probate process, all the assets owned by the deceased person will still remain in his name and this will make it impossible for his heirs and beneficiaries to be able to have any access to his estate. They can’t sell, use or give out any of his assets cause they are still in the name of the deceased person.

Depending on the law of the place of resident of the person, a will might not go through the process of probate when its total value isn’t up to a particular amount. This amount varies from state to state. In some states if the total dollar value of the estate is below $30,000 the estate won’t go through probate.

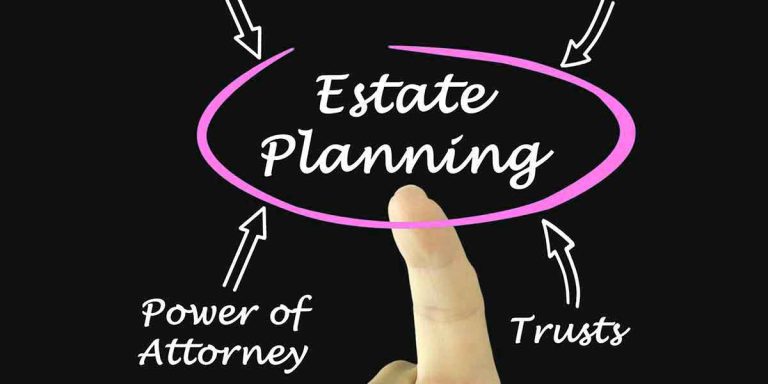

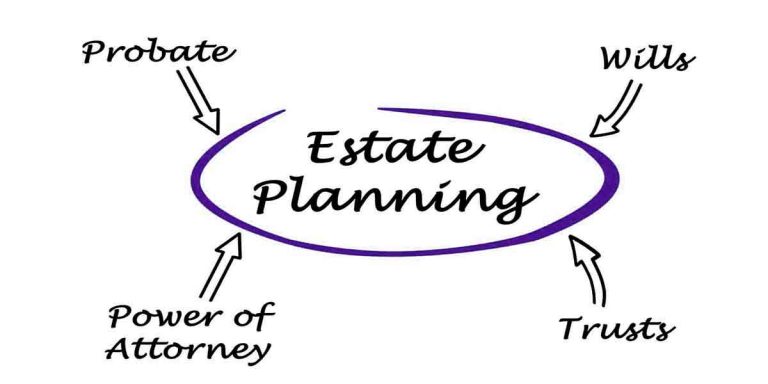

There are assets which are known as non-probate assets. These assets even though included in a will, they do not go through the probate process Non probate assets are those assets or properties which are not subject to the probate process. They bypass the probate process regardless of what the will says about them. They are not enlisted among the assets that will go through the process of probate. Some of these non-probate properties include assets which are in a trust, properties with a named beneficiary, assets which have a payable on death (POD) or transfer on death (TOD) designation, assets which are jointly owned, etc.

Setting up a living trust is a way to avoid the process of Probate. When you set up a trust, you give right of ownership to the trustee for the benefit of the beneficiary. The trustee has the authorization to carry out the instructions of the trust regarding the way the trust should be used. This kind of asset is non-probate assets as they go straight to the beneficiary.

There are properties which the beneficiaries were named so they do not pass through the probate process. Some examples include life insurance policies, IRAs, 401(k)s, and pensions, etc.

Some assets already have their designated beneficiaries at the event of death. These assets do not go through the probate process. Example of asset which have a payable on death (POD) designation include bank accounts with beneficiaries while real estate, vehicles, etc. are examples of assets which have the transfer on death (TOD) designation.

Assets which are jointly owned do not pass through the probate process. This is common with married couples. When a partner dies, the jointly owned assets automatically go to the surviving spouse.

FAQ

Question: if a will does not go through probate can it be used to distribute an estate among heirs?

Answer: if the worth of the will is below that of the state requirement then it can be used without probate.

Question: why do people avoid probate?

Answer: different people avoid probate for various reasons, but basically most people avoid probate because of some basic factors like time, cost, delay, privacy, etc.

Probate attorney

The probate attorney is the ones which represent the interest of the heirs, beneficiaries, creditors, etc. in court. You need the assistance of a probate attorney to know the wills which do not need to go through the probate process and those which need to go through probate. Contact our attorneys today for consult and hire.