16th circuit chooses Campbell

The circuit judges of the sixteenth Judicial Circuit have chosen Reginald N. Campbell for partner judge. Campbell will be confirmed on Monday, March 2, and

The circuit judges of the sixteenth Judicial Circuit have chosen Reginald N. Campbell for partner judge. Campbell will be confirmed on Monday, March 2, and

There has been a multiplication of dedication programs in Canada lately. An incredible 92% of Canadians report enrollment in a most un-one program, as indicated

The COVID-19 pandemic makes them contemplate my family’s wellbeing and our collaboration with general society in manners that I never have. I know I’m in

The universe of venture guidance and monetary arranging is loaded with issues. Things like irreconcilable situations, dark divulgences and a general absence of straightforwardness leave

The COVID-19 Pandemic has altered the country’s point of view on numerous things, and home arranging is certainly one of them. Coronavirus has fundamentally expanded

Same-sex relationships currently partake in similar legitimate rights as hetero relationships in the United States. Nonetheless, as same-sex couples actually face interesting bequest arranging issues,

Horticulture is an indispensable piece of the New York State economy. Our ranchers keep on giving positions and new, privately developed food while helping protect

What is Gender Pay Gap The sexual orientation pay hole or sex wage hole is the normal distinction between the compensation for people who are

What is Gray a Divorce At the point when the term was first authored, it alluded to people who separated following 40 years or a

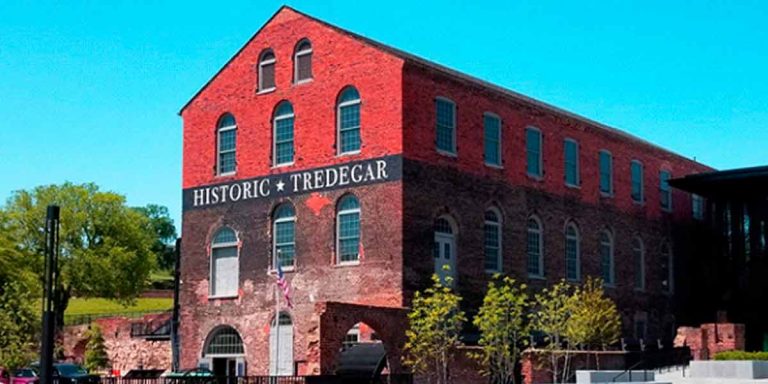

As improvement interest in the space keeps on getting with a new riverfront place of business arranged close by, the proprietor of the memorable Tredegar