The Truth About Wills and NY Probate Court

Debunking the Myth: Why a Will Is Your Ticket to Probate Court It is one of the most persistent and dangerous misconceptions in the world

Home » fiduciary responsibility

Debunking the Myth: Why a Will Is Your Ticket to Probate Court It is one of the most persistent and dangerous misconceptions in the world

Choosing Between a Will and a Trust in New York Planning for the future is one of the most profound acts of responsibility and care

Your Guide to Administering an Estate in New York When a loved one passes away, the grief can be overwhelming. Amidst the sorrow, practical and

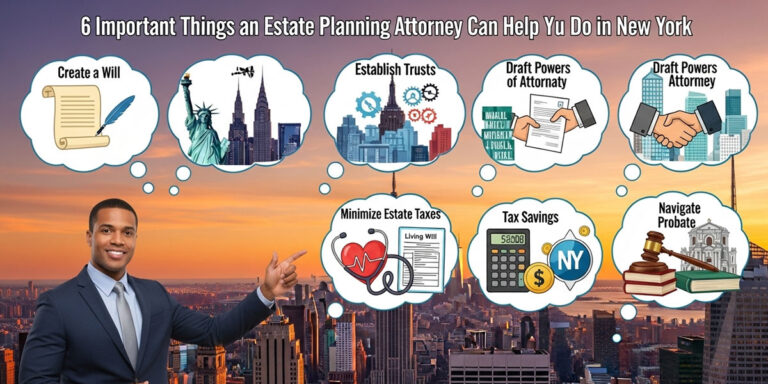

The True Value of an Estate Planning Lawyer: 6 Key Benefits When many people hear the term “estate planning,” their minds immediately jump to a

Your Guide to Estate Planning in the 10004 Zip Code Life in the 10004 zip code is lived at the very southern tip of Manhattan,

Why You Need a Local 10005 Estate Planning Attorney Life in the 10005 zip code is lived at the very center of the financial universe.

Why You Need a Local 10006 Estate Planning Attorney Life in the 10006 zip code is lived at the very nexus of global finance and

Why You Need a Local 10280 Estate Planning Attorney Life in the 10280 zip code offers a unique New York experience—an exclusive, serene residential enclave

Why You Need a Local 10028 Estate Planning Attorney Life in the 10028 zip code is lived at one of the most prestigious addresses in

Your Ultimate Guide to Finding and Hiring an Estate Planning Lawyer The process of creating an estate plan is one of the most significant and

Special Needs Trusts: Why a Specialist, Not a Generalist, Is Essential For a parent or guardian of a child or loved one with special needs,

A Blueprint for Success: Insights from Russel Morgan’s Podcast What separates a competent legal practitioner from a truly successful legal entrepreneur? In a landscape saturated

Protecting Your Brooklyn Legacy: An Expert Guide Brooklyn is more than just a borough; it is a global icon of culture, diversity, and resilience. From

Fighting for Dignity: Recognizing and Responding to Elder Abuse The decision to place a beloved parent or family member in a nursing home is one

Why You Need a Local 10014 Estate Planning Attorney The 10014 zip code is more than just a location; it’s a legendary landscape at the

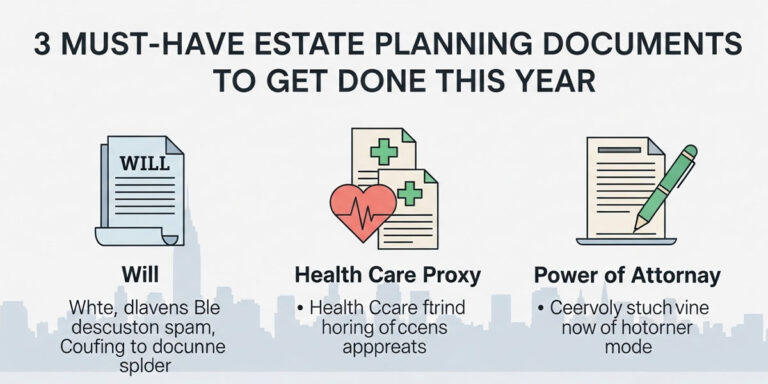

Your Essential Estate Planning Checklist for This Year Each new year brings a fresh sense of purpose—a time to set goals, make improvements, and focus

New York Trusts: Your Guide to Asset Protection and Probate Avoidance Securing your legacy and ensuring its smooth transition to your loved ones is paramount

Why You Need a Local 10007 Estate Planning Attorney The 10007 zip code is a unique and powerful corner of Manhattan, a place where historic

Why You Need a Local 10038 Estate Planning Attorney The 10038 zip code is the historic and financial epicenter of New York City. From the

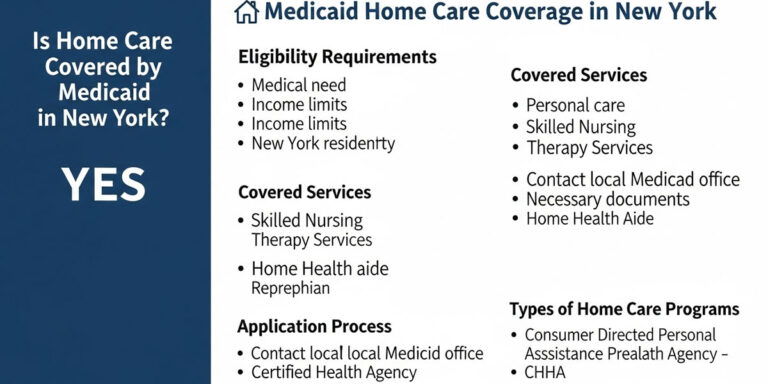

Getting Medicaid to Cover Home Care in New York For the vast majority of New Yorkers, there is no place like home. The desire to

Avoiding the Pitfalls: The Most Common Mistakes in Estate Planning Creating an estate plan is one of the most profound acts of responsibility and care

Core Wisdom from Estate Planning Attorneys The world of estate planning can seem overwhelmingly complex. With its talk of trusts, probate, guardians, and fiduciaries, it’s

Why You Need a Local 10020 Estate Planning Attorney The 10020 zip code is not just a location; it is a global symbol of power,

Why You Need a Local 10016 Estate Planning Attorney The 10016 zip code is a dynamic and vital artery of Manhattan, pulsing with the energy

Why You Need a Local 10017 Estate Planning Attorney The 10017 zip code is the nerve center of global commerce and diplomacy. It is the

Why You Need a Local 10022 Estate Planning Attorney The 10022 zip code is a global synonym for influence, affluence, and ambition. It is the

Why You Need a Local 10012 Estate Planning Attorney The 10012 zip code is not just a location; it’s a living, breathing epicenter of art,

Why You Need a Local 10013 Estate Planning Attorney The 10013 zip code is a world-renowned capital of style, culture, and finance. It is a

How the Medicaid Look-Back Period Affects New York Estate Planning For generations of New Yorkers, the goal has been simple: work hard, buy a home,

Why You Need a Local 10030 Estate Planning Attorney The 10030 zip code is the cultural and historic epicenter of Central Harlem. From the architectural

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC