The Role of an Executor in New York Probate

The Role of an Executor in New York Probate: A Comprehensive Guide Serving as an executor of an estate in New York is a significant

Home » estate planning process in 2024

The Role of an Executor in New York Probate: A Comprehensive Guide Serving as an executor of an estate in New York is a significant

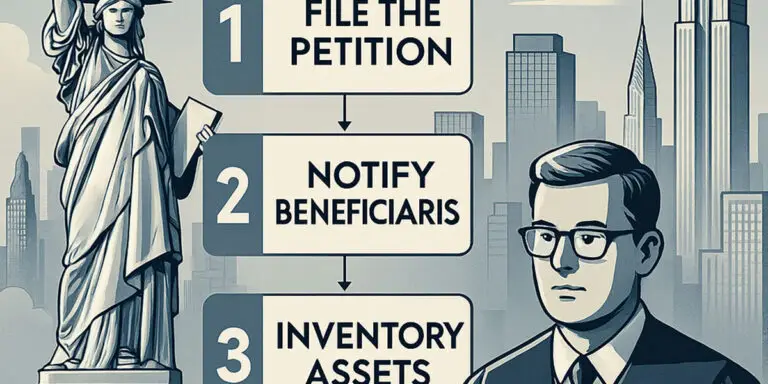

How to File for Probate in New York State: A Comprehensive Guide Filing for probate in New York State can seem like a daunting task,

What Happens If Someone Dies Without a Will in New York? Dying without a will, also known as dying intestate, can create significant complications for

Understanding the Probate Process in New York: A Step-by-Step Guide When a loved one passes away, dealing with their estate can feel overwhelming, especially when

The Importance of Updating Your Estate Plan in New York: Planning for 2025 and Beyond Estate planning is not a one-time event; it’s an ongoing

Trust and Estate Planning Attorney in New York: What to Expect in 2025 As we look toward 2025, understanding the landscape of trust and estate

Guardianship for Minors in New York: A Parent’s Guide As parents, securing your child’s well-being is paramount. While it’s a topic no parent wants to

Estate Planning Attorney White Plains NY: Protecting Your Legacy Planning for the future can feel daunting, especially when it involves complex legal matters like estate

Finding the Right Will Attorney in Queens: Protecting Your Legacy Creating a will is one of the most important steps you can take to protect

Estate Tax Planning for New York Residents: A Comprehensive Guide Estate tax planning is a critical aspect of wealth preservation for New York residents. Both

New York Probate: Expert Strategies to Avoid It Welcome to Morgan Legal Group, P.C., your trusted legal resource for estate planning in New York. Probate

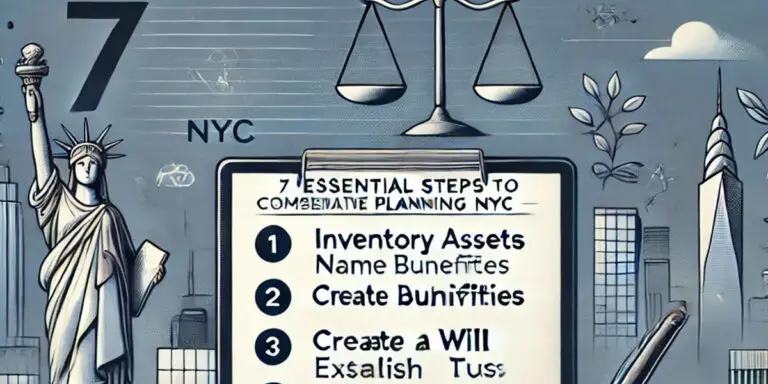

7 Essential Steps to Comprehensive Estate Planning in NYC Welcome to Morgan Legal Group P.C., your trusted partner in estate planning in New York City.

Health Care Proxy vs. Living Will in New York: Key Differences Planning for your future healthcare needs is a vital aspect of estate planning. In

Power of Attorney in New York: What You Need to Know A Power of Attorney (POA) is a critical estate planning document that allows you

Understanding Trusts in New York: Types and Benefits Trusts are powerful legal tools used in estate planning to manage assets, protect beneficiaries, and achieve various

Understanding Revocable Trusts on Long Island For Long Island residents seeking comprehensive estate planning solutions, a revocable trust, often called a living trust, offers a

Understanding Revocable Trusts in Brooklyn, New York As an experienced estate planning attorney in New York with over 30 years of practice, I’ve witnessed firsthand

Understanding Essential Estate Documents in New York Estate planning can feel overwhelming, especially when faced with a multitude of legal documents and complex terminology. In

Finding the Right Probate Lawyers: Sullivan County, NY Expertise Dealing with the loss of a loved one is an emotionally difficult experience, and navigating the

Finding the Right Probate Lawyer in Suffolk County: A Comprehensive Guide When you’re dealing with the complexities of settling a loved one’s estate in Suffolk

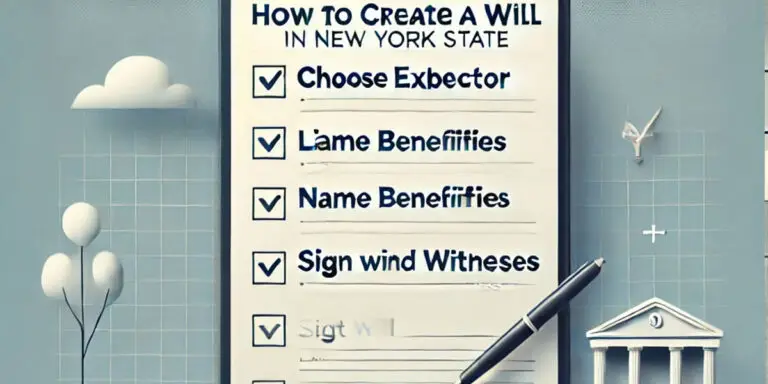

How to Create a Will in New York State: A Step-by-Step Guide Creating a will is one of the most important steps to protect your

Do I Really Need an Estate Plan? Unveiling the Truth in NY Many individuals in New York question whether they truly need an estate plan.

Finding the Right Probate Lawyer in NYC: Your Essential Guide Securing the right legal representation is paramount when you’re facing the daunting task of navigating

Navigating Probate in Kings County: Why You Need a Local Expert When faced with the responsibility of administering a loved one’s estate in Kings County

Top Reasons to Hire a Probate Attorney in New York The loss of a loved one brings immense grief, and the ensuing legal process of

Guardianship Lawyer in New York: Protecting Your Loved Ones in 2025 When a loved one becomes unable to care for themselves or manage their affairs

NY Probate Attorney Duties: What to Expect When someone passes away in New York, the probate process begins. This legal process can seem complex and

Probate Attorney Near Me in 10012: Your Local Guide Dealing with the loss of a loved one is always difficult. Navigating the complexities of probate

Probate Lawyer Long Island: Navigating Estate Administration Losing a loved one is an emotional time. Navigating the probate process adds stress. This is especially true

Probate Attorney Near Me 10017: Your Midtown East Guide Searching for a “probate attorney near me 10017” indicates a need for assistance. Probate, the process

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap