Nobody needs to envision spending a tremendous lump of cash on taxes. Nonetheless, making the vital strides today might help with relieving the measure of taxes you or your recipients might pay later on.

Numerous things has changed as of late concerning estate taxes and there are then again other potential changes coming up like the Biden tax increment. Contingent upon your conditions, these progressions could influence the amount you leave as an inheritance. Consequently, it is fundamental that you examine your technique as time passes by, particularly on the off chance that you sit on a goldmine.

The best methodology

At the point when it comes down to settling on these decisions, we accept a group approach is the best system. Your monetary consultant can work with you close by your legitimate and assessment experts to help in guaranteeing that your procedure reflects your present wishes including the current tax laws.

Underneath we have given you a little insight into the proposed Biden’s expense increment and what it might mean for the rich. Nonetheless, before we dig into that. Allow us to consider what home arranging is.

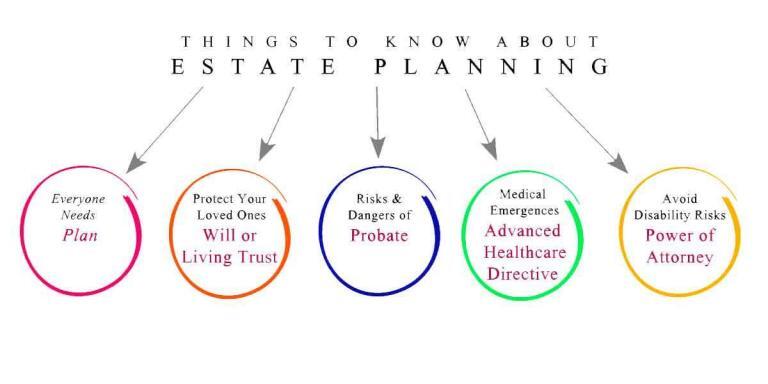

What is Estate Planning?

However normal, not every person knows what the term estate planning is. Also, this is on the grounds that an enormous level of individuals don’t see the significance in estate planning. Estate planning is essentially an arrangement an individual makes while alive for the administration, dispersion, and removal of their resources during their lifetime of after their death.

Kinds of resources that can contain an individual estate includes houses, vehicles, protection, offers and stocks, banks accounts, including other individual properties.

It is vital that you contact a wills and estate lawyer and plan your estate as inability to do as such won’t only affect you, but your family and those you care about. Furthermore, this is on the grounds that when you die without a will, your resources will be shared dependent on the intestate laws of your state

Affluent Americans and the Scramble to change their estate plan

Affluent Americans are rushing to alter their estate plan before the year ends, restless that Democrat Joe Biden will wind up winning the U.S. official political decision and increment charges.

The undeniable concern is that the White House and Congress could get immersed in a “Blue Wave” of Democratic successes that gave Biden the power to propose and pass a broad arrangement of tax changes.

Well off people are particularly stressed that an exception permitting individuals to surrender to $11.58 million to beneficiaries, without bequest or gift charges, could be ended before it officially terminates in 2025.

Liberals need to raise estate taxes to the “chronicled standard,” in light of the party’s foundation. That could bring about cutting the exclusion to $5.49 million, the figure set before President Donald Trump marked a general assessment charge that additional advantages for companies and affluent Americans in 2017, consultants said.

It is vague how the political decision will unfurl for sure, if any duty changes will pass. Be that as it may, as Biden is by all accounts winning the surveys, rich people are scrambling to make trusts and go over existing ones preceding the year finds some conclusion to forestall 2021 expense results, consultants said.

Biden’s Tax Reform Plan

Biden has many plans arranged taking everything into account. He anticipates returning the estate taxes to 2009 levels, to finance paid family and clinical leave, according to his site.

His arrangement likewise incorporates expanding on long haul capital additions, which is the benefit acquired by selling resources whose qualities have expanded. Citizens who brag of pay above $1 million would pay a 39.6% personal assessment on the benefit, instead of the current layered methodology that maximums out at 20% for individuals with $441,450 or more pay.

Do you live in New York and need to survey your estate plan? Try not to spare a moment to contact an estate planning lawyer New York.