Long Island Mansions

It is a fact that Long Island has one of the best and beautiful mansions that includes floors to high elevation, a personal pool and maybe even an aromic garden to have you enjoy the nature around the mansion making it more embracive. With its natural build buildings with pure marble or granite inside and all the extra space to enjoy the luxury. Such luxury like a bathroom or bedroom of choice and long hallways filled with windows or even paintings from around the world that’ll both show you a scene of the outside world as you walk to the refrigerator every time. Anyone would be more than happy to live in a place like this. You are also minutes away from the beach or friendly home owners around the amazing neighborhood.

WHERE ARE THEY LOCATED

These Long Island mansions are located at; The Great Neck, Glen Cove, Bayville, Lattingtown, Manhasset, Muttontown, and Mill Neck. These towns are considered the Gold Coast. More mansions are also located in the Hamptons and Huntington. There are several other locations spread throughout Long Island also. They range from 5 million to at least an estimate of 40 million which can have you owning your own castle.

FAQ

1. What are Gold Coast mansions known for?

Gold Coast mansions are known for being owned by the wealthiest people in America and even past presidents. Basically anyone who can afford a house that’s over a million dollars and can live the lifestyle. It’s also been an inspiration on F Scott Fitzgerald’s The Great Gatsby.

2. How many Gold Coast mansions were built?

Ranging from the late 1800s to the early 1900s at least over 1000 Mansions that have been built in the Gold Coast owned by the wealthiest people in America.

3. What is the largest house on Long Island?

The largest private house would have to be in the Hamptons New York on Long Island. It is called the Fairfield where the main house is over 60,000 ft.² while the entire floor is close to double.

4. What towns are considered the Gold Coast of Long Island?

The following towns are part of the Gold Coast in Long Island. The Great Neck, Glen Cove, Bayville, Lattingtown, Manhasset, Muttontown, and Mill Neck. All of these towns have a total of over a million dollars of a total estate which makes these neighborhoods that expensive.

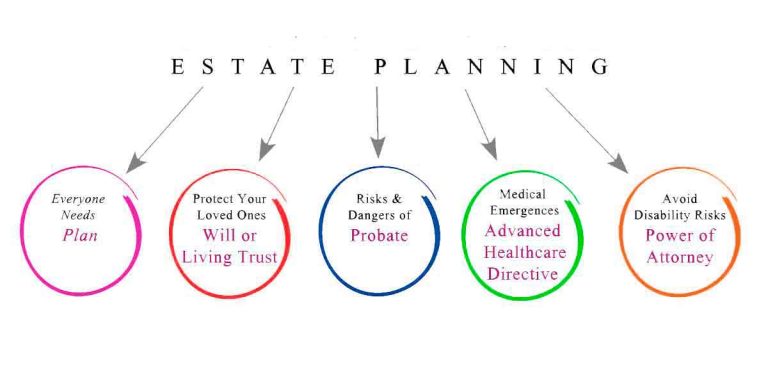

5. What is the benefit of hiring an attorney if free forms are available online?

Once an attorney is hired you have a professional say towards your Estate and where it’s being distributed. Free aren’t very beneficial and reliable because you’re not getting as much service as you would from an actual attorney. There may be some fallacies and interferences on these forms. This can cause difficulties at any court process difficult, longer and expensive.

6. How do you Resolve Disagreements in Estates?

Most disagreements are resolved in court between the executor or administrator of the Will between other beneficiaries that may be listed also. The court makes the final decision depending on what the best decision is unless a kind of compromise is discussed between the two. It also needs to fit the needs of the writer of the Will and what’s best for him or her.

7. Why is it so expensive to live on Long Island?

Long Island is expensive to live in because of the high pricing of housing and property tax that needs to be paid for. According to New York State there is a state tax in the federal tax as well. Besides the high pricing there’s also bigger estates in great neighborhoods close by But that’s only about a percentage of Long Island. There’s also a high quality of wineries, breweries, amazing sceneries and even castles owned by those who can afford it.

8. Can an irrevocable trust be amended?

One thing you can do by is to remove assets you’ve written within the trust. You will still have the trust on file but it’ll be one that is empty. There’s also booking an appointment with the court through a trustee since he or she is responsible for making any adjustments as well in the trust even if it’s irrevocable. As long as there’s a good reason for the modification.

9. Can I collect unemployment if I go to school?

To receive unemployment you need to document that you’re looking for work and enrolled in school to receive some benefits.

10. How long do you have to work to collect unemployment in NY?

According to the official ny.gov website, you need to be working for at least a month and in file at least $2,700 in wages.Your base period also needs to be higher than your quarter wages.