A lot of things changed this year due to the Coronavirus pandemic. People worked, schooled and traded from the comfort of their homes; thanks to the virtual world technology has helped create. Planning your estate during the lockdown must be stressful as almost if not every process included had to be conducted virtually and to be honest it’s effective.

A virtually created Estate plan

According to the law, a will must be drafting In the presence of two witnesses to be legally valid. This is done to protect individuals against undue influence or fraud which has become widespread in estate planning. Due to the coronavirus outbreak, some governments went ahead to create a new legislation which makes it possible for witnesses to be present either physically or virtually. As a result, will and other estate plan document which are witnessed through platforms like Zoom and the likes will be considered as valid. This legislation was introduced in England and wales.

How to make plans during the pandemic.

- Plan Your Estate Early

The coronavirus pandemic may discourage several people from planning their estate due to fear of contracting the virus. If you are among these people, you need to remember that life is full of uncertainly. No one knows when death will arrive. Therefore, you need to be courageous and plan your estate for the sake of your future and those you care about. Call an estate planning attorney and make inquiry about their virtual estate planning option.

- Be Calm and Draft a Plan

The pandemic is making most people feel like the end of the world id near. People are panicking. Death tolls are increasing day by day. No one knows who’s next. Of course, I understand that this is a trying time, but if you want to make it past this dark hour, you must ensure that you know what is happening. You are encouraged to get facts regarding the outbreak from the Centers for Disease Control (CDC) for recent updates and the best strategies to reduce exposure. As soon as you have handled your risk of exposure, you can then look at the future by evaluating your estate plan. If you are yet to draft an estate plan, now is the best time to do so. Remember, if you die without an estate plan, the state government will dictate how your estate will be shared and this might affect those you care about.

- Contact an Estate planning attorney.

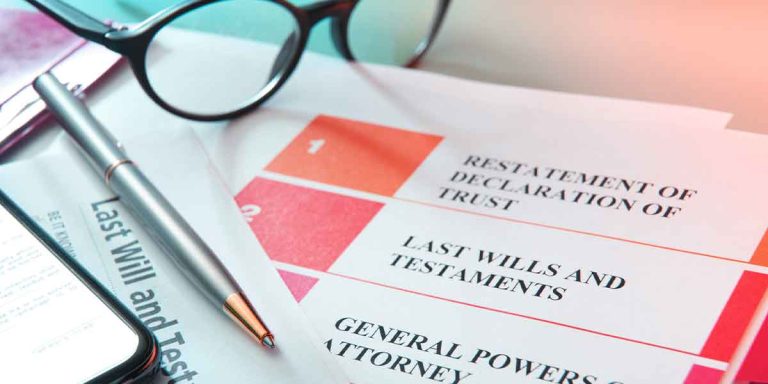

Estate planning attorneys can draft an estate plan that makes everything easy for your family; no probate, no huge estate taxes or anything that can cause complications for them. We all hold our family at high esteem. In fact, one major reason why people create an estate plan very early is because of their family. You see, to create an estate plan that can protect your family, you need to hire a competent estate planning attorney.

Estate planning can be complicated; it is not one of those basic DIY tasks. If you fail to make a good estate plan, you may be risking the future of your family as well as properties. You need to hire an estate planning Lawyer Buffalo New York for your estate planning projects.

Remote witnessing is important.

Legally, the signing of your will or other estate plan document must be physically witnessed by at least two persons who must also sign to attest their presence. However, due to the coronavirus pandemic this became difficult. However, the state governor Andrew Cuomo signed an executive order On April 7 to allow for remote witnessing for wills trusts, healthcare proxies, and statutory gift riders. This means that your will can be witnessed by live video conferencing. All you need to do is connect with the witnesses, and they watch while you draft your document. When drafting your will, your family members cannot be your witness if their names are in the will. Therefore, your witnesses have to be external parties, most likely outside your home.

Why should you hire an estate planning attorney?

Estate planning is a tedious and technical process best suited for an estate planning attorney. Nobody except maybe a probate attorney wants to go through the difficult process of probate which is done to check the authenticity of a will. A professional estate planning attorney will help you create which is the best and advisable way to avoid probate, additionally peradventure your estate is bound to undergo probate, the estate planning attorney can and will help you and your loved ones prepare.

Contact us

Talk to our experienced estate planning attorney in New York. Embark on a smooth estate planning journey today, and be sure to get quality and a hundred percent professional assistance.