A Simple Guide to Estate Planning in New York

Your Step-by-Step Guide to NY Estate Planning For most people, the phrase “estate planning” sounds intimidating. It conjures images of complex legal documents, vast fortunes,

Home » Estate Planning Lawyer » Page 6

Your Step-by-Step Guide to NY Estate Planning For most people, the phrase “estate planning” sounds intimidating. It conjures images of complex legal documents, vast fortunes,

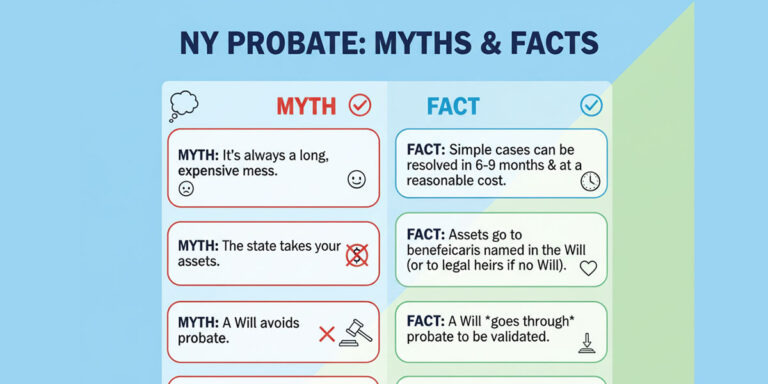

NY Probate Misconceptions: The Complete Guide The Truth About Probate in New York State In my three decades as a New York probate attorney, I

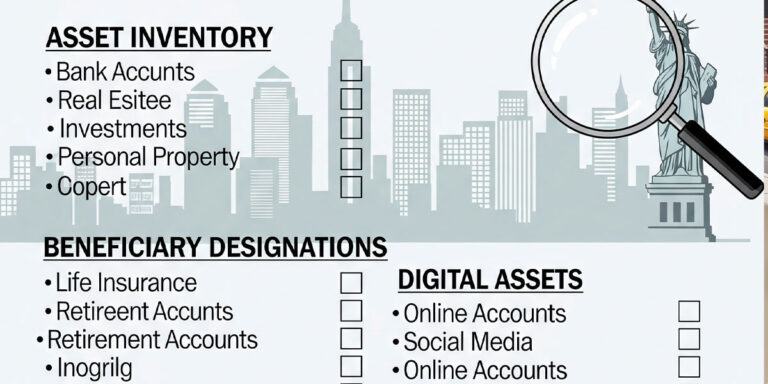

Your Essential NY Estate Planning Checklist Embarking on the estate planning process can feel like preparing for a monumental journey. The destination—peace of mind for

Understanding Home Care Options in New York For many older New Yorkers, the dream is to remain in their homes, surrounded by familiar comforts and

NY Reverse Mortgages: An Estate Planning Deep Dive For many older New Yorkers, their home is not just a place of cherished memories; it is

Your Ultimate NY Estate Planning Checklist For many New Yorkers, the term “estate planning” conjures images of immense wealth, sprawling mansions, and complex legal battles

Top Reasons for a New York Power of Attorney Imagine for a moment that you are suddenly unable to manage your own affairs. A sudden

8 Estate Plan Updates for Your New York Divorce Divorce is one of life’s most profound and challenging transitions. While you are navigating the emotional

A Comprehensive Guide to Powers of Attorney in New York Planning for the future is one of the most profound acts of responsibility we can

Estate Planning Explained: What It Is, How It Works, and Why You Need It The term “estate planning” often conjures images of immense wealth, sprawling