Charitable Trusts in New York

Charitable Trusts in New York: Giving Back While Planning Your Estate Many individuals in New York are passionate about supporting charitable causes. A charitable trust

Home » Estate Planning Details » Page 2

Charitable Trusts in New York: Giving Back While Planning Your Estate Many individuals in New York are passionate about supporting charitable causes. A charitable trust

Medicaid Trusts in Queens, New York: Protecting Your Assets and Securing Your Future Navigating the complexities of Medicaid eligibility in Queens, New York, can be

Understanding Trusts and Wills in New York: A Comprehensive Guide Planning for the future can feel overwhelming, especially when it involves complex legal instruments like

Navigating Your Future with a Trust and Estate Lawyer in New York Planning for the future involves many important decisions, but few are as critical

Estate Planning Attorney Near Me 10010: Securing Your Future in Midtown Manhattan Planning for the future may feel overwhelming, but it’s one of the most

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A

Understanding Real Estate Closings: A Comprehensive Guide As we explore the complexities of home ownership and purchases, there are some facts that need to be

Estate Planning Attorney Near Me 10010: Secure Your Future in Midtown Manhattan Planning for your future can feel daunting. This is why is is important

Estate Planning Attorney Near Me 10035: Protecting Your Family in East Harlem & Upper East Side Planning for the future is a critical responsibility, especially

Estate Planning Attorney Near Me 10029: Securing Your Legacy in Upper Manhattan Planning for the future can feel overwhelming, especially when it involves complex legal

Estate Planning Attorney Near Me 10036: Your Guide to Securing Your Future Planning for the future can feel overwhelming, but it’s also one of the

Understanding Veterans Benefits for Elder Care in New York: A Comprehensive Guide New York is home to a large and proud community of veterans who

Will Lawyer Long Island: Protecting Your Family and Securing Your Legacy Planning for your future and the well-being of your loved ones is a critical

Estate Planning for Seniors in New York: Protecting Your Legacy and Securing Your Future As we age, planning for the future becomes increasingly important. Estate

Understanding Health Care Power of Attorney in New York: Protecting Your Medical Wishes Planning for your future healthcare needs is crucial to responsible estate planning.

Guardianship for Incapacitated Adults in New York: Protecting Your Loved Ones When a loved one becomes incapacitated and unable to manage their own affairs, it

Medicaid Planning for Long-Term Care in New York: Protecting Your Future As people age, the need for long-term care becomes an increasing concern. Long-term care

Will Lawyer Brooklyn: Protecting Your Loved Ones and Securing Your Legacy Planning for the future can be a complex and emotional process, but it’s one

Revocable Trust Queens: Secure Your Future and Protect Your Loved Ones For residents of Queens, New York, planning for the future often involves considering how

Wills And Trusts Brooklyn: Protecting Your Future Planning for your future and the well-being of your loved ones involves careful consideration of your assets and

Divorce Laws in New York State: What You Need to Know Going through a divorce is a challenging and emotionally taxing experience. Understanding the divorce

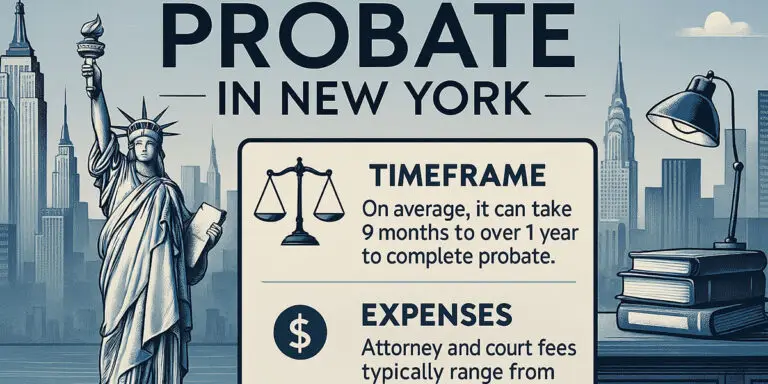

Timelines and Costs of Probate in New York: What to Expect When a loved one passes away, navigating the legal and financial complexities of probate

Avoiding Probate in New York: Is It Possible? Probate, the legal process of administering a deceased person’s estate, can be time-consuming, costly, and stressful for

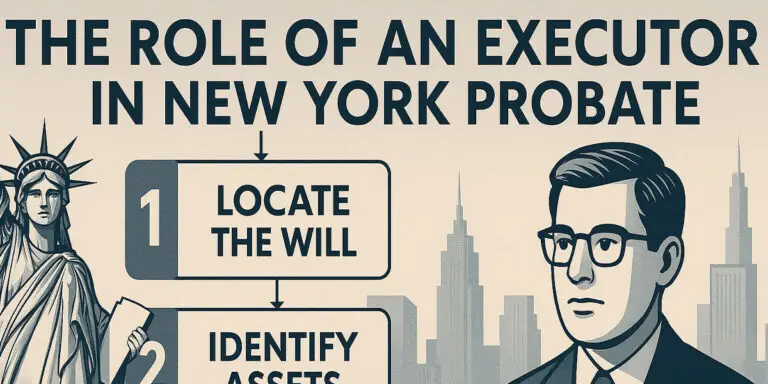

The Role of an Executor in New York Probate: A Comprehensive Guide Serving as an executor of an estate in New York is a significant

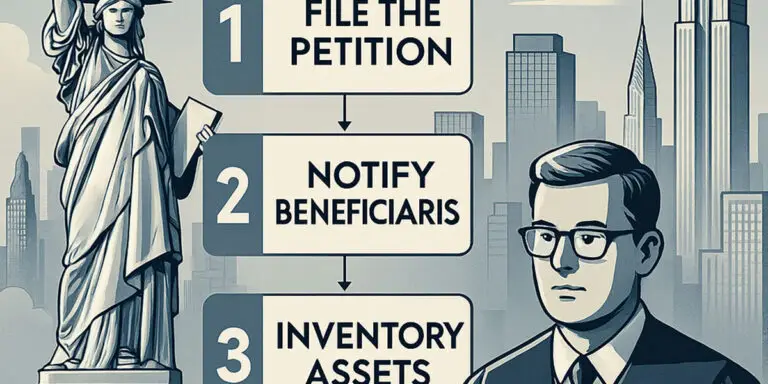

How to File for Probate in New York State: A Comprehensive Guide Filing for probate in New York State can seem like a daunting task,

What Happens If Someone Dies Without a Will in New York? Dying without a will, also known as dying intestate, can create significant complications for

Understanding the Probate Process in New York: A Step-by-Step Guide When a loved one passes away, dealing with their estate can feel overwhelming, especially when

The Importance of Updating Your Estate Plan in New York: Planning for 2025 and Beyond Estate planning is not a one-time event; it’s an ongoing

Trust and Estate Planning Attorney in New York: What to Expect in 2025 As we look toward 2025, understanding the landscape of trust and estate

Guardianship for Minors in New York: A Parent’s Guide As parents, securing your child’s well-being is paramount. While it’s a topic no parent wants to

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap