The issue of estate planning is one every family is supposed to take serious and plan but, it can be very difficult to do as it is a subject that has to do with emotions. It involves families planning ahead of death and incapacitation. Notwithstanding it should be done as it is safer to plans one’s estate. Before engaging in the process of estate planning, it is very important you know what it is all about as it is a very complex process and involves many steps.

Estate planning is a safety measure ahead of either incapacitation or death. It gives you the opportunity to still manage your assets even after death. Different life events could be responsible for the need to create an estate plan. Estate planning becomes very vital to different persons at different times. This could be a result of difference in life style, type of job or business, relationships, etc.

Generally there are some basic life events which are responsible for the need for someone to plan their estate.

Government tax policies: Many persons see this as a serious reason for estate planning. They wouldn’t want their loved ones to pay huge taxes on their estate when they are no more. Most persons set up certain type of trust for this reason.

Increase in a person’s net worth: As you continue to enlarge financially, it becomes necessary to plan your estate to either ensure proper management of your assets in the case of incapacitation or in the case of death.

Birth of a child: Another life event that triggers estate planning is the birth of a new child. You have to plan your estate so as to make provision for the new child. This is also the case when there is a new grandchild.

Marriage: In the event of marriage, you want to include your spouse into your estate plan.

Inheritance: This is one of the major reasons many people plan their estate. It gives the opportunity to plan for their heirs.

Other life events which could trigger the need for estate planning include: Acquisition of new assets, death of a loved one, divorce, and sale of a property.

In estate planning, there is no laid –down time rule as to when you should kick start the process. When one eventually decides to start this process, it is important that necessary steps are taken to avoid mistakes which could cost much. These processes are outlined below

Knowing the basics

It is vital to learn about anything including estate planning before starting it. This will give you an insight of how everything is being done, the dos and don’ts involved, what and what you should avoid, what you must do etc. in the case of estate planning, learning about the whole process will give you an insight how government tax policy might affect your estate.

What are your objectives?

Getting your reasons and objectives straight will help you to selects potential fiduciaries perfectly. These include: executors, trustees, heirs, etc.

Insurance review

This step is very necessary as it help you align your insurance (if you have any) with your estate plan. This might open you up to the idea of a life insurance as it will make your family income sure when you pass on.

Reviewing and finalizing your plan

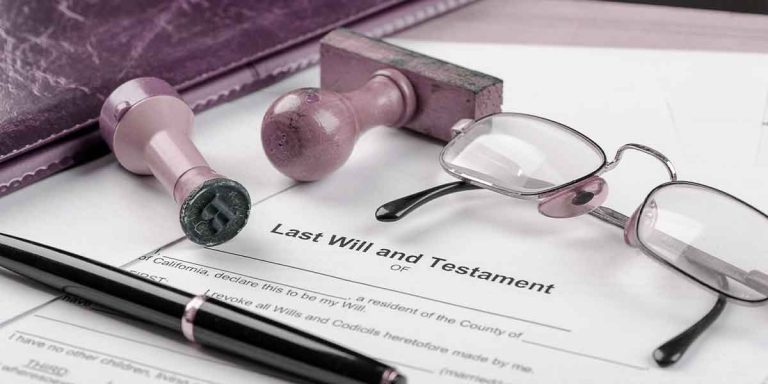

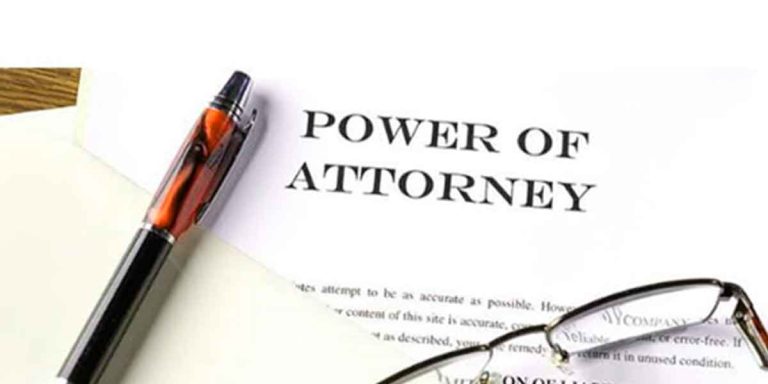

This is the step in which you double check the structure of your plan. Make sure everything is in total alignment. Make sure all necessary documents like will; power of attorney, etc. are included in your plan.

Involving your attorney

After you have put everything in place, it is time you involve your estate planning attorney. He will make sure that everything is in order. If there are necessary changes to make or possible errors, he will set them right.

Execution

After everything has been checked and confirmed by your estate planning attorney. It is time to formalize documentations.

Regular review and update of your estate plan

This should be done at a regular interval. It could be a yearly interval; it could be an interval of

Two years. This step is important because after planning your estate, other life events still occurs and it is important that these events are reflected in your estate plan. The birth of a child after planning your estate is a reason to update your estate so as to make provision for the child in your estate.

For legal and professional guidance, reach out to our attorneys today.