Why Estate Planning is Important for Young People

Estate planning is often associated with older adults, particularly those who have accumulated significant assets over a lifetime. However, contrary to popular belief, estate planning

Home » Estate Planning Attorney near me Queens » Page 9

Estate planning is often associated with older adults, particularly those who have accumulated significant assets over a lifetime. However, contrary to popular belief, estate planning

Probate is a legal process that occurs after someone passes away, involving the validation of their will and the distribution of their assets. In New

Top 8 Reasons Why You Should Consider Estate Planning Estate planning is often misunderstood as something only necessary for the wealthy or elderly. However, this

Exploring the Legal Responsibilities of Parents in School Shooting Cases Attorney Russell Morgan, founding partner at Morgan Legal Group, recently shared his expert analysis on

NYC Probate and Estate Administration: Expert Guidance from Morgan Legal Group The probate and estate administration process in New York City can be complex and

Last Will and Testament Attorney in New York: Expert Guidance from Morgan Legal Group Creating a Last Will and Testament is an essential step in

Russell Morgan, Founding Partner at Morgan Legal Group, Explores Legal Ramifications for Parents in School Shooting Cases In a recent interview, Russell Morgan, founding partner

Russell Morgan, Founder and Partner of Morgan Legal Group Discusses Evolving Legal Standards In a recent interview, Russell Morgan, founder and partner of Morgan Legal

Probate Property Lawyer in New York: Expert Guidance from Morgan Legal Group The probate process in New York can be a complex and daunting experience,

Creating a Legal Will in Brooklyn, New York: Secure Your Legacy Creating a legal will is an essential aspect of estate planning that ensures your

Common Mistakes People Make When Estate Planning and How to Avoid Them Estate planning is critical in securing your legacy and ensuring that your assets

Old or Young, Take Control of Your HealthCare Now in New York Healthcare decisions are some of the most personal and critical choices you will

Estate planning is a critical process that ensures your assets are managed and distributed according to your wishes after your passing. However, many individuals make

Estate planning is more than just writing a will; it’s about protecting your legacy, securing your family’s future, and ensuring your wishes are honored. While

Estate planning is a crucial step in securing your family’s future and ensuring that your assets are distributed according to your wishes. However, many individuals

Do Estate Plan Documents Prevent Probate in New York? When it comes to estate planning, many individuals seek ways to simplify the transfer of their

Living Trust as an Essential Estate Document in New York Estate planning is an important step in securing your financial future and protecting your assets

Primary Estate Planning Documents You Should Have Estate planning is an essential aspect of financial management, especially in New York, where state-specific laws can significantly

Exploring Alternatives to Probate in New York Probate is a court-supervised process that validates a will, settles debts, and distributes the assets of a deceased

Disney Seeks to Dismiss Wrongful Death Suit Due to Disney+ Agreement The tragic loss of a loved one can lead to complex legal battles, particularly

Choosing a Guardian for Your Children in New York Choosing a guardian for your children is one of the most significant decisions you can make

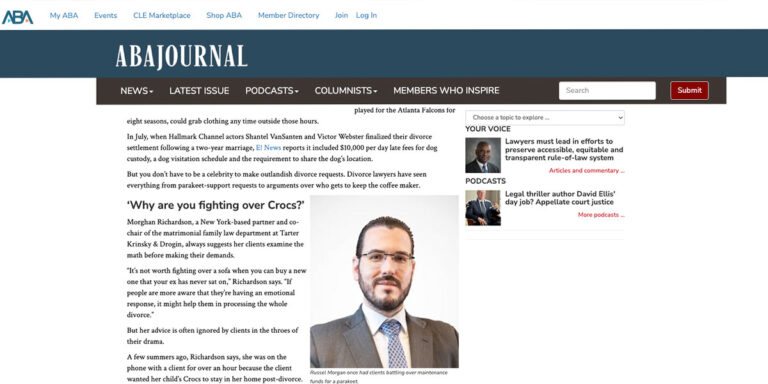

Outlandish Divorce Requests Seen by Attorneys Divorce is often an emotional and complex process, and sometimes, people can make surprising or even outlandish requests during

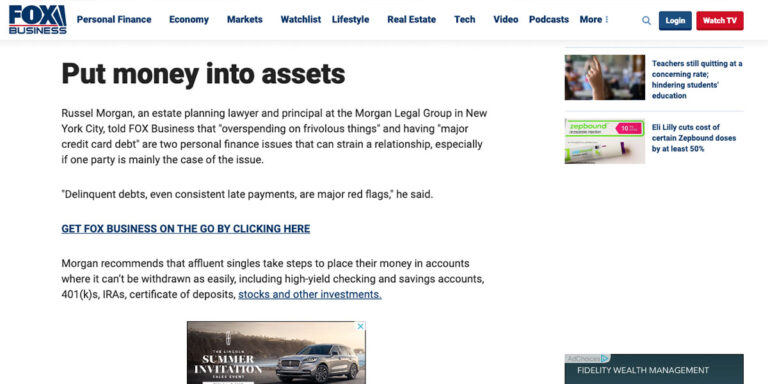

In today’s economic climate, protecting your assets is not just about saving money—it’s about strategic planning to ensure financial stability and security for the future.

The probate process in New York is a critical legal procedure that ensures the orderly distribution of a deceased person’s estate according to their last

Today, House Republicans unveiled their initial impeachment inquiry report, a comprehensive document detailing allegations of abuse of power and obstruction of justice against President Joe

All About Revocable Trusts in New York To ensure your assets are managed and distributed according to your wishes, estate planning is essential. One of

Probate New York Attorneys Probate can be one of the most complex and stressful aspects of estate administration. It involves the legal process of validating

Living Trust in New York Regarding estate planning in New York, a living trust is one of the most effective tools available to manage your

Estate Planning as a DIY Challenge In an era where information is more accessible than ever, many individuals feel empowered to take on challenges that

Rising Drug Overdose Rates and Legal Penalties in New York Drug overdose rates in the United States continue to climb year after year, raising significant

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap