Divorce

Understanding Divorce in New York Divorce is the legal dissolution of a marriage by a court. In New York, divorce can be complex, involving various

Home » Estate Planning Attorney near me Queens » Page 12

Understanding Divorce in New York Divorce is the legal dissolution of a marriage by a court. In New York, divorce can be complex, involving various

What is Credit Life Insurance in New York 2024? At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship,

Life Insurance and Probate: Understanding the Connection At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder law,

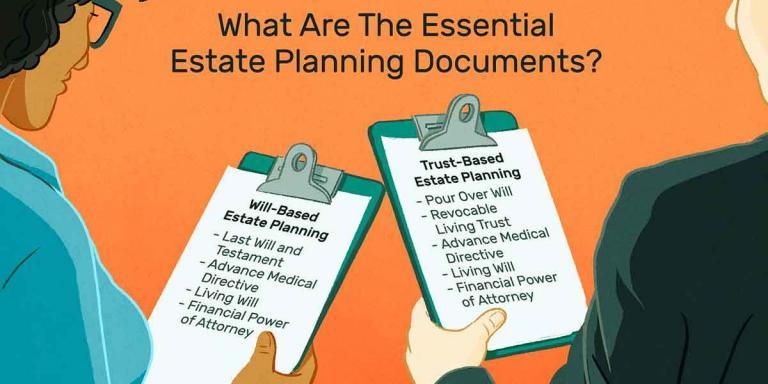

How to Make Good Estate Plans in New York 2024 At Morgan Legal Group, located in New York City, we specialize in estate planning, probate,

The Importance of Estate Planning in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder

How Funds Can Be Spent in a Supplemental/Special Needs Trust At Morgan Legal Group, located in New York City, we specialize in estate planning, probate,

Legal Will in NYC: Comprehensive Guide by Morgan Legal Group At Morgan Legal Group, located in New York City, we specialize in estate planning, probate,

Stay Safe on the Road This Summer: Legal Experts Remind Drivers As the summer holidays approach, more people take to the roads to enjoy vacations,

Understanding the Difference Between a Trust and a Will At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship,

Why You Need an Estate Plan At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder law, wills,

Experienced Guardianship Lawyer in Brooklyn At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder law, wills, and

Understanding Guardianship in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder law, wills, and

Previous Next Dear Valued Clients and Community, We want to address a concerning matter that has affected our Google Maps listing.Our online presence has recently

Experienced Guardianship Attorney in Queens At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship, elder law, wills, and

Difference Between Guardianship and Power of Attorney in NY At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, guardianship,

Understanding Conservatorship and Guardianship in New York: Protecting Vulnerable Individuals When a loved one becomes unable to manage their own affairs due to illness, injury,

Seven Things to Leave Out of Your Will, According to Experts Read on Kiplinger.com At Morgan Legal Group, located in New York City, we specialize

Understanding Incapacitation in a Living Trust in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder

Comprehensive Estate Planning with New York Attorneys At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder law, wills,

Estate Planning Tips for Blended Families in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder

Understanding the Basics of a Revocable Trust At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder law, wills,

Reasons to Revise Your Estate Plans in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder

The Role of an Executor: Do They Need a Probate Lawyer? At Morgan Legal Group, located in New York City, we specialize in estate planning,

Estate Planning for Property in Multiple States At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder law, wills,

Estate Planning Tips for Unmarried Couples in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder

Estate Planning Advice for Same-Sex Couples in New York At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder

Transfer Real Estate into a Trust in New York: A Comprehensive Guide At Morgan Legal Group, located in New York City, we specialize in estate

4 Key Mistakes Executors Often Make During The Probate Process At Morgan Legal Group, located in New York City, we specialize in estate planning, probate,

Probate Lawyer in Nassau, New York: Ensuring Smooth Estate Administration At Morgan Legal Group, located in New York City, we specialize in estate planning, probate,

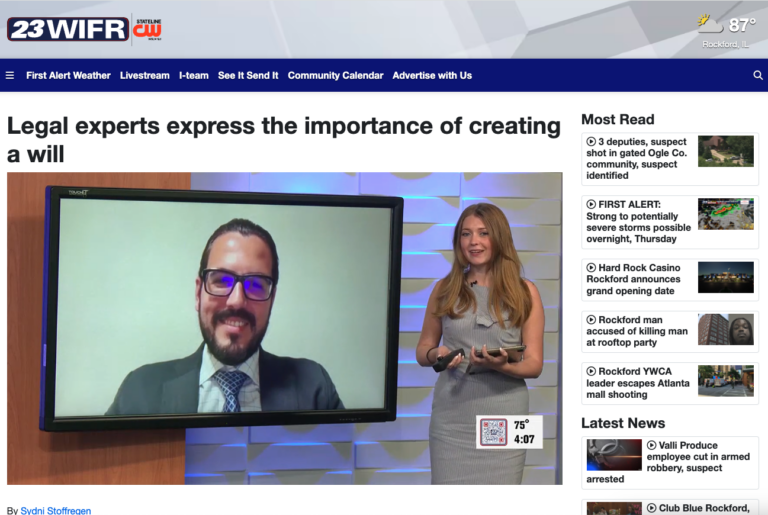

Legal Experts Stress the Importance of Creating a Will At Morgan Legal Group, located in New York City, we specialize in estate planning, probate, elder

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap