Veterans Benefits for Elder Care in New York

Understanding Veterans Benefits for Elder Care in New York: A Comprehensive Guide New York is home to a large and proud community of veterans who

Home » Estate planning Attorney near me 11010

Understanding Veterans Benefits for Elder Care in New York: A Comprehensive Guide New York is home to a large and proud community of veterans who

Will Lawyer Long Island: Protecting Your Family and Securing Your Legacy Planning for your future and the well-being of your loved ones is a critical

Estate Planning for Seniors in New York: Protecting Your Legacy and Securing Your Future As we age, planning for the future becomes increasingly important. Estate

Understanding Health Care Power of Attorney in New York: Protecting Your Medical Wishes Planning for your future healthcare needs is crucial to responsible estate planning.

Guardianship for Incapacitated Adults in New York: Protecting Your Loved Ones When a loved one becomes incapacitated and unable to manage their own affairs, it

Medicaid Planning for Long-Term Care in New York: Protecting Your Future As people age, the need for long-term care becomes an increasing concern. Long-term care

Will Lawyer Brooklyn: Protecting Your Loved Ones and Securing Your Legacy Planning for the future can be a complex and emotional process, but it’s one

Revocable Trust Queens: Secure Your Future and Protect Your Loved Ones For residents of Queens, New York, planning for the future often involves considering how

Wills And Trusts Brooklyn: Protecting Your Future Planning for your future and the well-being of your loved ones involves careful consideration of your assets and

Divorce Laws in New York State: What You Need to Know Going through a divorce is a challenging and emotionally taxing experience. Understanding the divorce

Timelines and Costs of Probate in New York: What to Expect When a loved one passes away, navigating the legal and financial complexities of probate

Avoiding Probate in New York: Is It Possible? Probate, the legal process of administering a deceased person’s estate, can be time-consuming, costly, and stressful for

The Role of an Executor in New York Probate: A Comprehensive Guide Serving as an executor of an estate in New York is a significant

How to File for Probate in New York State: A Comprehensive Guide Filing for probate in New York State can seem like a daunting task,

What Happens If Someone Dies Without a Will in New York? Dying without a will, also known as dying intestate, can create significant complications for

Understanding the Probate Process in New York: A Step-by-Step Guide When a loved one passes away, dealing with their estate can feel overwhelming, especially when

The Importance of Updating Your Estate Plan in New York: Planning for 2025 and Beyond Estate planning is not a one-time event; it’s an ongoing

Trust and Estate Planning Attorney in New York: What to Expect in 2025 As we look toward 2025, understanding the landscape of trust and estate

Guardianship for Minors in New York: A Parent’s Guide As parents, securing your child’s well-being is paramount. While it’s a topic no parent wants to

Estate Planning Attorney White Plains NY: Protecting Your Legacy Planning for the future can feel daunting, especially when it involves complex legal matters like estate

Finding the Right Will Attorney in Queens: Protecting Your Legacy Creating a will is one of the most important steps you can take to protect

Estate Tax Planning for New York Residents: A Comprehensive Guide Estate tax planning is a critical aspect of wealth preservation for New York residents. Both

New York Probate: Expert Strategies to Avoid It Welcome to Morgan Legal Group, P.C., your trusted legal resource for estate planning in New York. Probate

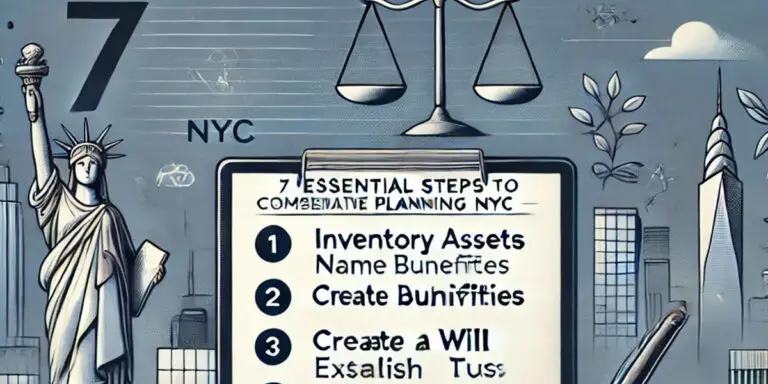

7 Essential Steps to Comprehensive Estate Planning in NYC Welcome to Morgan Legal Group P.C., your trusted partner in estate planning in New York City.

Health Care Proxy vs. Living Will in New York: Key Differences Planning for your future healthcare needs is a vital aspect of estate planning. In

Power of Attorney in New York: What You Need to Know A Power of Attorney (POA) is a critical estate planning document that allows you

Understanding Trusts in New York: Types and Benefits Trusts are powerful legal tools used in estate planning to manage assets, protect beneficiaries, and achieve various

Understanding Revocable Trusts on Long Island For Long Island residents seeking comprehensive estate planning solutions, a revocable trust, often called a living trust, offers a

Understanding Revocable Trusts in Brooklyn, New York As an experienced estate planning attorney in New York with over 30 years of practice, I’ve witnessed firsthand

Understanding Essential Estate Documents in New York Estate planning can feel overwhelming, especially when faced with a multitude of legal documents and complex terminology. In

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap