Estate Planning in NYC

Estate Planning in NYC: A Comprehensive Guide For New York City residents, estate planning is not merely a suggestion but a necessity. Indeed, living in

Home » Estate Planning Attorney Buffalo NY » Page 4

Estate Planning in NYC: A Comprehensive Guide For New York City residents, estate planning is not merely a suggestion but a necessity. Indeed, living in

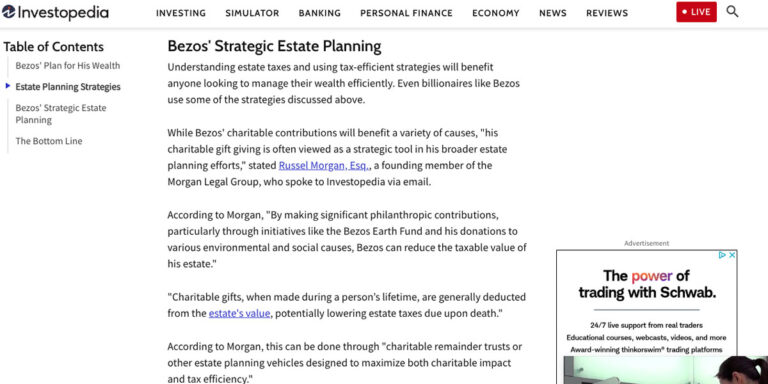

Estate Planning Strategies Inspired by Jeff Bezos Jeff Bezos’ Estate Planning Vision Jeff Bezos, the billionaire founder of Amazon, has expressed his intent to donate

Navigating NYC Probate: Why You Need a Probate Attorney Losing a loved one is an emotionally challenging experience. Furthermore, the process can quickly become overwhelming

Living Trusts in NYC: Your Expert Guide For New York City residents, planning for the future and securing your legacy is critical. Estate planning, therefore,

New York Trusts: Your Guide to Asset Protection and Probate Avoidance Securing your legacy and ensuring its smooth transition to your loved ones is paramount

Securing Your Digital Legacy: Digital Estate Planning in New York In today’s increasingly digital world, our lives extend far beyond the physical realm. We conduct

Safeguarding Your Assets: A Comprehensive Guide to Medicaid Asset Protection Trusts in New York for 2025 Preparing for long-term care can be an overwhelming process

The Role of Trusts in Protecting Assets from Creditors: A New York Guide to Financial Security As experienced asset protection attorneys at Morgan Legal Group,

Preparing for Potential Changes in Estate Tax Laws Post-Election: A New York Guide to Adaptable Planning As seasoned estate planning attorneys at Morgan Legal Group,

Planning for Digital Assets in Your Estate: A Comprehensive Guide for New Yorkers As experienced estate planning attorneys at Morgan Legal Group, we recognize that

The HEMS Standard: Guiding Trust Distributions and Protecting Beneficiaries in New York As experienced estate planning attorneys at Morgan Legal Group, we understand the vital

Strategic Gifting: Reducing Taxable Estates and Benefiting Heirs in New York As experienced estate planning attorneys at Morgan Legal Group, we understand the importance of

Living Trusts in Queens: Protecting Your Legacy in New York For Queens, New York residents, planning for the future is a significant responsibility. A “living

Incorporating Charitable Giving into Estate Plans: A Guide for New York Residents As experienced estate planning attorneys at Morgan Legal Group, we understand that estate

Navigating Your Legacy: Expert Estate Planning in New York City Indeed, securing your future and the well-being of your loved ones requires a thoughtful and

Utilizing Purpose Trusts for Business Succession: A New York Guide to Preserving Your Legacy As experienced estate planning attorneys at Morgan Legal Group, we recognize

Unlocking the Benefits: Why New Yorkers Choose Revocable Living Trusts As dedicated estate planning attorneys at Morgan Legal Group, we’ve witnessed firsthand the transformative power

Estate Planning Guide 2025: A Comprehensive Resource for New York Residents As we approach 2025, the need for a solid and comprehensive estate plan becomes

Advantages of Establishing Revocable Living Trusts in New York: A Comprehensive Guide As seasoned estate planning attorneys at Morgan Legal Group, we understand that planning

Impending Changes to Federal Estate Tax Exemptions in 2026: A Guide for New York Residents As we move closer to 2026, New York residents need

Utilizing Life Insurance in Estate Planning Amid 2025 Tax Changes: A New York Perspective As experienced estate planning attorneys at Morgan Legal Group, we understand

Estate Planning for Digital Assets in 2025: Navigating the Online World in New York As seasoned estate planning attorneys at Morgan Legal Group, we recognize

The Role of Revocable Living Trusts in 2025 Estate Planning: A New York Perspective As seasoned estate planning attorneys at Morgan Legal Group, we understand

Preparing Your Estate Plan for the 2025 Tax Bracket Adjustments: A New York Focus As we approach 2025, it’s crucial for New York residents to

The Therapist’s Couch: Tradition vs. Modern Practice – A Reflective Analysis As an attorney with a background steeped in the nuances of human interaction and

Incorporating Charitable Trusts in Your 2025 Estate Plan: A Strategic Approach As Morgan Legal Group looks towards 2025, we recognize that effective estate planning requires

Leveraging the Increased Gift Tax Exclusion in 2025 for New York Estate Planning As experienced estate planning attorneys, we at Morgan Legal Group understand that

The Impact of the 2024 Election on Estate Planning: A New York Perspective As experienced estate planning attorneys, we at Morgan Legal Group recognize the

Strategies to Avoid New York’s Estate Tax “Cliff”: A Comprehensive Guide As seasoned estate planning attorneys, we at Morgan Legal Group understand the intricacies and

Navigating New York’s Estate Tax “Cliff” in 2025 As we move toward 2025, a critical consideration for New York residents engaged in estate planning is

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap