8 charitable donations that save tax on your estate

Give away your assets as gift Here is another way to reduce death tax. However, this method is for those who are comfortable with giving

Home » Estate Plan » Page 47

Give away your assets as gift Here is another way to reduce death tax. However, this method is for those who are comfortable with giving

While there seem to be several online resources that can easily prepare a fast estate plan and provide relevant documentation, the question however comes in

It’s always painful to lose a parent. You can find yourself struggling to make funeral plans, or figure out what to do with all their

What is Joint tenancy? In a joint tenancy ownership, at least two people own a common property with both having equal rights to the property.

What is Estate tax exemption? When a person dies leaving valuable estate, the estate may be charged a tax known as estate tax. Notably, not

What is generation-skipping Transfer? There is generation skipping when an individual transfers assets by gift or inheritance to a beneficiary who is at least 37.5

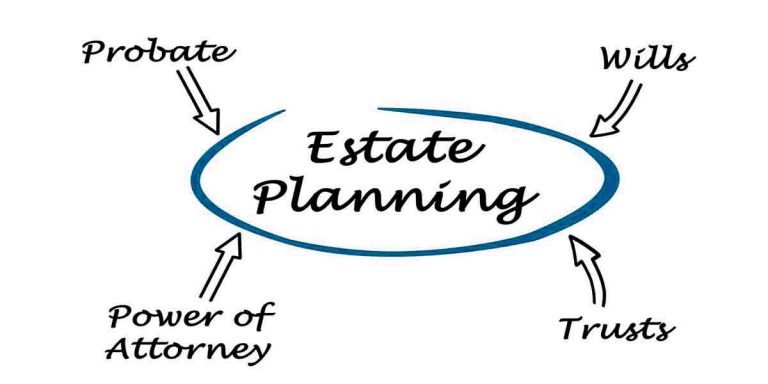

Over the years, estate planning has turned out as one of the most important plans one can make while alive. Thanks to this plan, several

We cannot overlook how much digitalized the world is right now. Almost everyone has digital assets, such as web domains, social media accounts, cryptocurrency wallets,

In the process of estate planning, you may consider whether to avoid probate or just let the law take its due course. To help you

Estate planning is a generalized plan. In other words, this plan isn’t meant for specific group of people such as the elites, celebrities, or those