Importance Of Estate Planning

Working With An Estate Lawyer It’s essential to work with a lawyer when it comes to protecting your home, assets and make sure the whole

Home » Estate Plan » Page 29

Working With An Estate Lawyer It’s essential to work with a lawyer when it comes to protecting your home, assets and make sure the whole

Many people spend most of their monetary anticipating matters relating to resource aggregation and judicious speculation like putting something aside for retirement. While many individuals

6 Legal Documents To Have Ready In Case You Get COVID-19 1. Monetary Power of Attorney A legal authority report is an authoritative record that

ESTATE PLANNING BENEFITS 1. Delegating a Executor Your executor will be the one to deal with your plans when you die. They can sell or

ESTATE PLANNING BEFORE DEATH Death is something no one wants to think about especially your own but it’s important to think of a plan when

Spousal Rights. There are laws set up engaging companions and administering the circulation of property in case of death. They would all be able to

According to her Will, NY designer, L’Wren Scott left behind a good amount of money to Rolling Stones legend, Mick Jagger. The Will For Mick

Paul Walker’s Will Paul Walker’s estate plan was trust-based which implies he had a revocable trust included. His will was to some degree short and

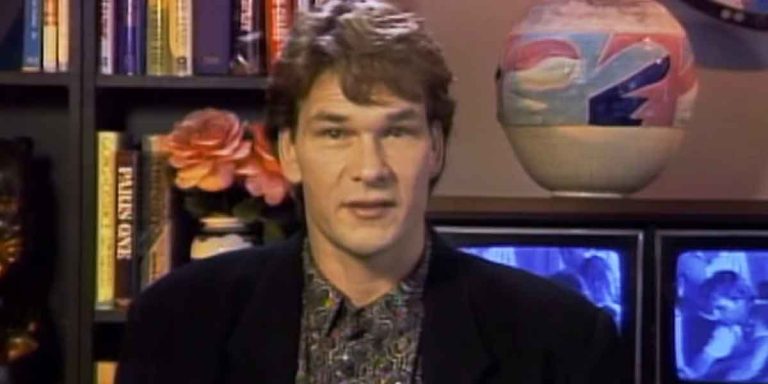

It’s been a very long time since entertainer, Patrick Swayze, died however he actually can’t Rest In Peace as his family and his widow, Lisa

Mickey Rooney And His Tragic Estate Story Mickey Rooney’s home was accounted for to be valued at $18,000 during this current period while his acting