In today’s economic climate, protecting your assets is not just about saving money—it’s about strategic planning to ensure financial stability and security for the future. Russel Morgan, an experienced estate planning lawyer and principal at Morgan Legal Group in New York City, emphasizes the importance of proper asset management, especially for those facing personal finance issues such as credit card debt or overspending. This guide provides detailed insights into asset protection strategies and how to manage your finances to safeguard your future effectively.

Why Asset Protection is Essential

Asset protection is crucial because it helps secure your financial future against unforeseen circumstances. Whether it’s shielding your wealth from creditors, protecting your investments, or ensuring your assets are properly managed, taking proactive steps can prevent financial losses. Morgan highlights that issues like delinquent debts, consistent late payments, and significant credit card debt can strain relationships and diminish your financial standing, making asset protection a top priority.

Common Financial Pitfalls

Russel Morgan identifies several common financial pitfalls that can impact individuals, particularly those with significant wealth. Overspending on non-essential items and accumulating major credit card debt are two frequent issues that can quickly erode financial stability. These habits not only jeopardize your financial health but can also affect your relationships if one partner consistently bears the brunt of the financial strain.

Delinquent Debts and Financial Red Flags

Morgan advises that delinquent debts and consistent late payments are significant red flags. Such financial behaviors signal poor money management and can lead to serious consequences, including damaged credit scores and increased difficulty in obtaining loans or favorable interest rates. Therefore, understanding the importance of financial discipline and accountability is key to maintaining a healthy financial profile.

Asset Protection Strategies

Protecting your assets involves more than just setting aside money in a savings account. It requires a strategic approach to where and how your money is invested and protected. Below are several effective strategies that Morgan recommends for safeguarding your wealth in New York.

1. Diversify Your Investments

One of the most effective ways to protect your assets is through diversification. Morgan advises individuals to maintain a balanced mix of high-risk and low-risk investments. High-risk investments, such as stocks and mutual funds, can yield significant returns but also come with the potential for loss. By offsetting these with more stable options, like bonds or certificates of deposit (CDs), you create a safety net that can cushion the impact of market volatility.

2. Use High-Yield Checking and Savings Accounts

High-yield checking and savings accounts are essential tools for asset protection. These accounts provide a safe place to store your money and offer interest rates that exceed those of standard accounts, allowing your savings to grow over time. Morgan suggests that affluent individuals consider these accounts as a way to build their savings while maintaining easy access to funds securely.

Benefits of High-Yield Accounts

High-yield accounts are FDIC-insured up to the legal limits, providing security against bank failures. Additionally, they offer liquidity flexibility, which is important when emergencies arise. Choosing accounts with competitive interest rates can significantly increase your savings without exposing your money to the high risks associated with stock market investments.

3. Invest in Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs, are another cornerstone of asset protection. These accounts provide tax advantages and safeguard your money from immediate withdrawal, ensuring that your retirement savings remain intact. Morgan stresses the importance of maxing out contributions to these accounts, especially for individuals looking to secure their financial future.

Tax Benefits and Asset Protection

Retirement accounts offer significant tax benefits, including deferred taxes on growth and, in some cases, tax-free withdrawals. By contributing regularly to these accounts, you reduce your taxable income while ensuring that your assets are protected and growing over time.

4. Establish Trusts and LLCs

For entrepreneurs and high-net-worth individuals, setting up trusts or Limited Liability Companies (LLCs) can provide an additional layer of asset protection. Trusts allow you to control how your assets are distributed, and they can shield your wealth from creditors. Meanwhile, LLCs are beneficial for keeping personal and business finances separate, protecting your personal assets from business liabilities.

Creating a Trust

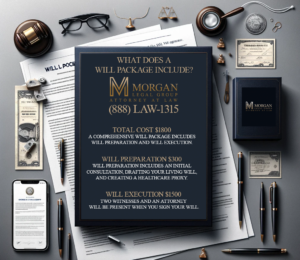

Morgan recommends establishing a revocable or irrevocable trust, depending on your specific needs. A revocable trust allows you to maintain control over the assets during your lifetime, while an irrevocable trust offers enhanced protection from creditors and tax benefits. Consulting with an experienced attorney is essential to determine the best type of trust for your situation.

Managing Risks with Asset Protection

Effective asset management also involves minimizing risks associated with investments and personal finance. Morgan advises regularly reviewing your financial plan to ensure it aligns with your long-term goals. This includes assessing your asset allocation, rebalancing your portfolio when necessary, and staying informed about market trends that could impact your investments.

Legal Safeguards

Working with a knowledgeable estate planning attorney can help you implement legal safeguards to protect your wealth. These may include drafting asset protection plans, updating your will, and ensuring your estate documents reflect your current financial situation and intentions. Morgan Legal Group provides comprehensive estate planning services that can help you secure your assets against unforeseen challenges.

Conclusion

Protecting your assets requires proactive financial management and strategic planning. You can safeguard your wealth against potential risks by diversifying your investments, utilizing high-yield accounts, maximizing retirement contributions, and setting up trusts or LLCs. Russel Morgan and the Morgan Legal Group in New York City are here to guide you through every step of the process, ensuring that your assets are well-protected and your financial future is secure. For tailored advice on how to protect your wealth, contact us today.