Estate planning is the summation of all the legal process involved in creating a system that guarantees the proper management, preservation and allocation of an estate in the event of incapacity or death of an estate owner. It is a crucial life plan that should be engaged in by every estate owner

We can’t live forever and as such, after death every estate plan is concluded by bequest or disbursement of assets to family, organization or individual as stated by the estate owner.

Working with an estate planning attorney

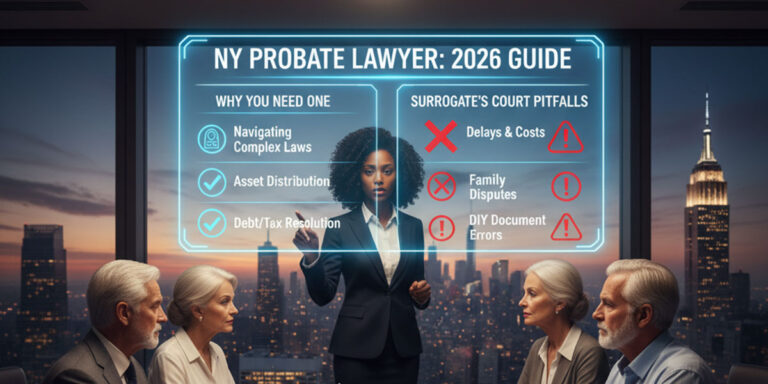

The only way to overcome the stress and hurdles that may arise during estate planning is to consult and hire an experienced estate planning attorney.

Estate planning attorneys otherwise known as probate Attorneys are experienced law practioners with in-depth knowledge and understanding of estate matters. They are trained professionals with years of mentoring, learning and continued legal education in the processes of estate planning.

Steps and documents involved in estate planning

- Plan for allocating estate.

After you must have evaluated your estate it is time to decide what parts and portion of it to be bequeathed and to whom it should. This is fundamental as it is the one of the important reasons for engaging in the fruitful process of estate planning. To ensure due and effective allocation of your estate on your death, the estate planning attorney will help you prepare the following documents;

- Last will and testament: wills are simply what an estate owner wants regarding disbursement of their estate. As basic as it might seem, it is a very powerful estate plan document, which is the bedrock that holds the desires of an estate owner in the event of death or incapacitation. Our firm’s estate planning attorney helps draft a comprehensive and detailed will, while considering all your assets in Buffalo New York and those that are better left out of the will.

- Living trust: In place of a will, a trust might be appropriate, as it bypasses probate. An estate planning attorney will transfer your estate into a living trust, a document that enables your beneficiaries get their allocation without hindrance or delay by the court proceedings of probate. With a living trust, you can designate portions of your estate to go toward certain things while you’re alive. If you become ill or incapacitated, your selected trustee can take over. Upon your death, the trust transfer assets to your designated beneficiaries, without undergoing probate, which is the court process that may otherwise distribute your property, in a manner which you may not have intended.

- Incapacity planning.

This is a plan that helps to avoid future surprises as life changes are bound to occur. Health and financial issues are one of the life changes that can arise and you want to ensure your directives are effectively followed to the latter, what then happens if you are not in the best position to make decisions regarding your estate? Be at rest, because the following documents help you to overcome the challenges incapacity might bring.

- Power of attorney: Incapacitation might occur during life situations and it is advisable to have someone step in and fill the void, who you trust to make decisions on your behalf. This is a document by which you appoint a trusted individual who would make good financial decisions , on your behalf and management of your estate should you become incapacitated.

- Healthcare surrogate: Your healthcare surrogate or the Medical power of attorney enables you authorize an individual to make medical decisions on your behalf when you become unable to make them yourself. Decisions like what medical process to take, foreign examine and the likes.

- Mitigating cost and cmplications

Some processes in estate planning such as probate are money consuming, court probate fees and state taxing on your assets can result in losing parts of your estate that is better allocated to your beneficiaries. An estate planning attorney helps you to minimise the effect of this process by ensuring the following;

- Tax evaluation: this is essential to nte6 as some taxes may bind your allocated estate and it can cost your beneficiaries a fortune, an estate planning helps you to avoid heavy taxing.

- Gifting: charitable donations help to minimise taxing on your estate and your designated beneficiaries have nothing to worry about.

- Holding property jointly: combining all of your estates makes estate taxng to be less heavy and it secures effective distribution of your estate

Contact our firm

Looking to plan your estate the right way? Talk to our experienced and reliable estate planning attorney in Buffalo, New York. Embark on a smooth estate planning journey today, and be sure to get quality and a hundred percent professional assistance.