For residents of Manhasset, NY, securing a lasting legacy and ensuring your family’s financial future demands proactive legal foresight and expert guidance. Estate planning is not merely a luxury reserved for the affluent; it is a fundamental and indispensable commitment to protecting your assets, clearly articulating your deepest wishes, and providing enduring security for your loved ones. A distinguished estate planning attorney in Manhasset, NY specializes in crafting comprehensive plans that effectively distribute your assets, minimize costs and complexities, and establish clear directives for managing your estate should incapacitation or passing occur.

This authoritative cornerstone guide is meticulously designed to illuminate the intricacies of estate planning and probate avoidance, offering Manhasset residents a clear, strategic pathway to securing their future and preserving their legacy in 2026 and beyond.

The Indispensable Value of Estate Planning in Manhasset, NY

Estate planning encompasses far more than the mere drafting of a will; it represents a holistic and integrated strategy for managing your assets during your lifetime and ensuring their seamless and efficient transition upon your passing. For residents of Manhasset, NY, a well-structured estate plan is critical, as it adeptly addresses unique local considerations while rigorously adhering to the complex nuances of New York State and federal laws.

Why Every Manhasset Resident Needs a Robust Estate Plan

- Fortifying Asset Protection: Strategically shielding your hard-earned assets from undue taxes, potential creditors, and future disputes, thereby preserving wealth for your intended beneficiaries across generations.

- Ensuring Clarity and Mitigating Family Discord: Offering crystal-clear instructions regarding asset distribution, effectively preventing potential family strife, minimizing emotional burden, and simplifying an inherently difficult time for your loved ones.

- Strategic Incapacity Planning: Establishing legally binding mechanisms, such as Durable Powers of Attorney and Advance Directives, for managing your financial and healthcare decisions should you become unable to do so yourself, avoiding intrusive court interventions and ensuring your wishes are respected.

- Optimizing Costs and Expediting Processes: Implementing strategic tools and methods designed to significantly reduce administrative expenses, court fees, and expedite the often-lengthy asset transfer process typically associated with probate.

- Protecting Special Needs Beneficiaries: Crafting specialized trusts (e.g., Supplemental Needs Trusts) that provide essential financial support for beneficiaries with disabilities without jeopardizing their eligibility for crucial public benefits.

- Securing the Future of Minor Children: Designating trusted guardians for minor children and establishing robust trusts to manage their inheritance until they reach a responsible age, ensuring their well-being and financial stability.

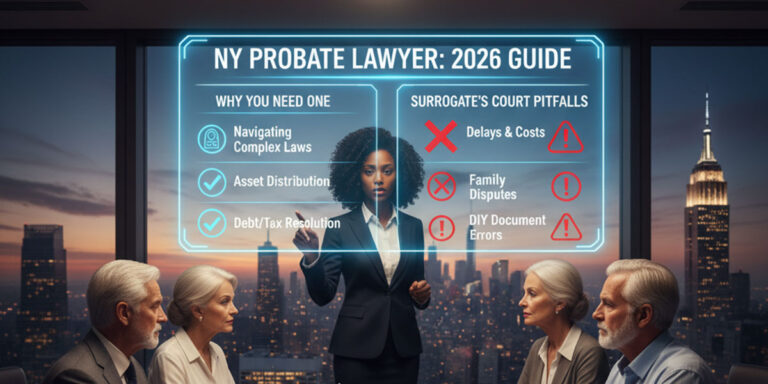

Decoding Probate: What It Is and Why Proactive Avoidance is Key

Probate is the formal legal process through which a deceased person’s will is authenticated and validated by the Surrogate’s Court, their assets are meticulously inventoried, debts and taxes are settled, and the remaining property is distributed to designated beneficiaries. In New York, this process can often prove to be lengthy, expensive, and public, potentially tying up valuable assets for months, or even years. Many astute individuals and families proactively seek to avoid probate to conserve precious time, reduce significant costs, and maintain a crucial level of privacy regarding their personal financial affairs.

Strategic Mechanisms for Probate Avoidance

Living Trusts: A Powerful Tool for Seamless Asset Transfer

A living trust is an exceptionally sophisticated and versatile legal instrument that permits you, as the “grantor,” to transfer ownership of your assets into the trust during your lifetime, while crucially retaining full control as the “trustee.” Upon your passing, a successor trustee, whom you have carefully designated, distributes these assets directly to your named beneficiaries without the necessity of court intervention. This process is inherently immediate, entirely private, and substantially reduces the time and expense commonly associated with probate. Depending on the unique nature and complexity of your estate, a revocable living trust can be effectively combined with a “pour-over” will for optimized benefits and comprehensive coverage. To ensure its proper establishment, funding, and meticulous execution, professional assistance from an experienced estate planning attorney is absolutely paramount.

Beyond Trusts: Other Effective Probate-Bypassing Mechanisms

While a living trust stands as an exceptionally versatile cornerstone, it is not the sole method available to circumvent the probate process. Other highly effective strategies that can be integrated into a comprehensive estate plan include:

- Joint Ownership with Rights of Survivorship: Holding real property (e.g., real estate) or financial accounts jointly with rights of survivorship (e.g., Joint Tenancy, Tenancy by the Entirety) allows assets to automatically pass directly to the surviving owner(s) outside of probate upon the death of one owner, simplifying transfer.

- Strategic Beneficiary Designations: Meticulously naming beneficiaries on specific accounts such as retirement funds (IRAs, 401ks), life insurance policies, annuities, and even bank accounts (Payable-on-Death/Transfer-on-Death accounts) ensures these assets transfer directly to the named individuals upon your death, bypassing probate entirely and with minimal delay.

- Strategic Gifting: Thoughtfully structured gifting of assets during your lifetime can effectively reduce the size of your taxable estate and avoid probate for those gifted assets. However, this strategy requires meticulous planning to adhere to federal and New York State gift tax laws and annual exclusion limits. An experienced estate planning attorney can provide invaluable guidance through the complexities of gifting, ensuring full compliance and maximizing benefits while avoiding potential pitfalls.

Comprehensive Benefits of a Strategic Estate Plan in Manhasset

The myriad advantages of a well-executed estate plan extend far beyond mere probate avoidance. It serves as an enduring testament to your precise wishes and a robust shield for your loved ones, addressing critical facets of your financial, medical, and personal legacy with clarity and authority.

Protecting Your Legacy and Ensuring Loved Ones’ Security

- Ensuring Seamless Management During Incapacity: By designating a trusted Power of Attorney for financial matters and an Agent for healthcare decisions (through an Advance Directive or Health Care Proxy), you ensure someone you trust implicitly can manage your affairs if you become incapacitated, preventing intrusive and costly court-appointed guardianships.

- Precise and Efficient Asset Distribution: Your meticulously crafted estate plan dictates precisely who receives which assets, in what manner, and at what time, eliminating ambiguity and significantly reducing the potential for disputes among heirs.

- Safeguarding Vulnerable Beneficiaries Through Trusts: Establishing protective trusts for minors, young adults, or individuals with special needs ensures their inheritance is managed responsibly, shielded from mismanagement, creditors, or premature dissipation, protecting their future.

- Mitigating Estate Tax Burdens: Implementing advanced strategies, such as various types of trusts and charitable giving, can effectively minimize exposure to both federal and New York State estate taxes, thereby preserving substantially more wealth for your intended beneficiaries.

- Substantial Reduction in Costs and Probate Duration: As thoroughly discussed, a proactive and well-structured estate plan significantly cuts down on legal fees, court costs, and administrative expenses typically associated with the probate process, saving your estate considerable resources.

- Expedited Asset Transfer: Assets held within properly funded trusts or those with designated beneficiaries bypass the often-protracted probate process, allowing for significantly quicker and more efficient distribution to your heirs, providing timely support.

Partnering with an Expert Estate Planning Attorney in Manhasset, NY

Estate planning is a profoundly personalized and intricately complex process; it is never a one-size-fits-all endeavor. The labyrinthine complexities of state and federal laws, coupled with your unique family dynamics, personal values, and diverse financial portfolio, unequivocally necessitate professional legal guidance. Relying on generic online templates or DIY solutions can lead to critical errors, leaving your family vulnerable, your assets unprotected, and your ultimate wishes unfulfilled. A seasoned estate planning attorney provides invaluable expertise and strategic insight to:

- Conduct a comprehensive analysis of your specific assets, liabilities, family structure, and long-term objectives.

- Advise on the most suitable and effective legal instruments, including but not limited to wills, various types of trusts, durable powers of attorney, and advance medical directives.

- Meticulously draft legally sound, customized documents that comply fully with all pertinent New York State and federal regulations.

- Implement advanced strategies for optimal tax minimization and efficient probate avoidance.

- Ensure your estate plan is regularly reviewed and updated to accurately reflect significant life changes, evolving financial circumstances, and amendments to applicable laws.

For Manhasset residents, choosing a local and reputable attorney means partnering with a legal professional who possesses a nuanced understanding of the community’s unique context, local property values, and is readily accessible to address your concerns with personal attention and tailored advice, ensuring your plan is perfectly aligned with your local needs.

Your Next Step: Secure Your Family’s Future Today with Expert Guidance

Entrusting your invaluable legacy to a competent and compassionate estate planning attorney is a critical investment in your ultimate peace of mind and the enduring prosperity of your family’s future. It serves as a profound testament to your unwavering dedication to their well-being, ensuring that your final wishes are honored precisely as intended and your hard-earned assets are protected for generations to come. Do not leave these vital decisions to chance, or to the complexities and potential pitfalls of intestacy laws (dying without a valid will).

The intricate legal landscape of estate planning demands a meticulous, knowledgeable, and empathetic approach. We invite you to contact us today to schedule a confidential and comprehensive consultation with a leading estate planning attorney proudly serving Manhasset, NY. Let us help you craft a tailored estate plan that profoundly reflects your values, secures your family’s prosperity, and provides you with the unwavering confidence that your legacy is in expert, local hands.