Although it is common knowledge that estate planning must be included in financial planning, it is often procrastinated. In most cases, this is because you are not aware of the list of documents you will need to best serve you.

Most people think that only trust fund and will is enough to chart out an estate plan. But there is a lot more information required if you want your property to be seamlessly passed on to your loved ones after your demise. An ideal estate plan must include details about the provisions for control of your assets in the event of your inability to do so.

Must-Have Documents for Estate Planning

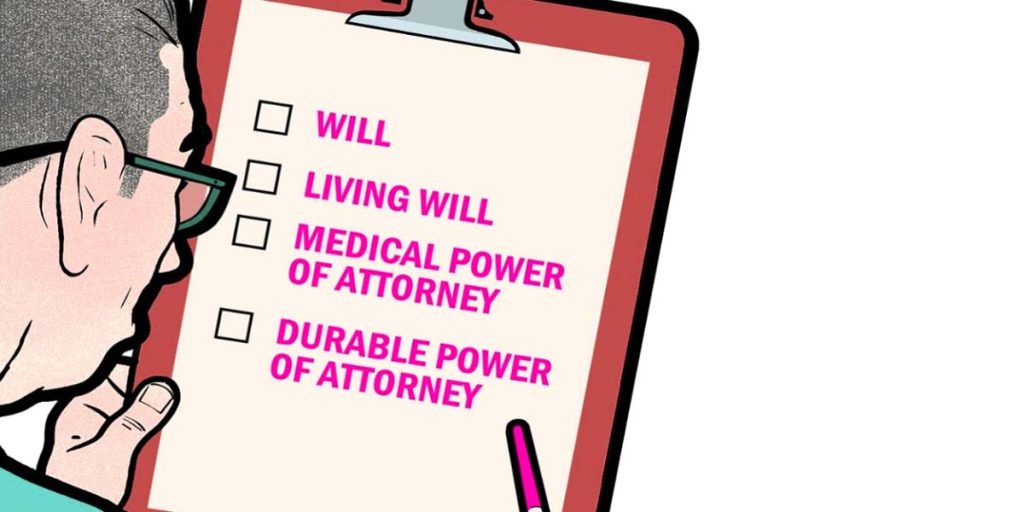

Any well-laid estate plan must include the following documents:

Will and Trust

A will or trust is not only for the rich and wealthy as per common assumption. A will or a trust is a mandatory component of estate planning, even if the assets are not worth a lot of money. A will ensures that the property of the deceased is appropriately disbursed to the right heirs following the wishes of the individual. Trusts can help lower estate taxes or tackle legal issues in some cases. The will or trust must be properly framed and worded with the help of an estate planning law firm.

Estate planning and management rules vary from state to state. For instance, you must search for “Estate planning firm in Manhattan” online to get the listed attorneys in the Manhattan area.

The will or trust must be consistent and unambiguous in the allocation of assets outside of the will to the beneficiary. For instance, you cannot name your son and your brother as the beneficiary for your insurance policy proceeds. This will lead to unnecessary legal conflict and bitterness amongst the heirs.

Trusted Power of Attorney

A powerful power of attorney or POA must be chosen as an agent to act on behalf of you in situations where you will not be able to do so. In the absence of power of attorney, the court gets the right to decide the future of your assets. The court’s decision may not always be favorable to you, so it is best to appoint a POA.

The powers of a POA are handled real estate, financial transactions, and take legal decisions on your behalf. POA is typically revocable if the principal individual is physically and mentally able to act by himself.

Power of attorney can be a spouse, a family member or a trusted friend who is financially savvy.

Designated Beneficiaries

There is always a certain portion of your property that can pass on to your heirs without being mentioned in the will, e.g. 401K earnings. In estate planning, a beneficiary will have a pivotal role to play in these cases. All insurance policies must not only have a beneficiary but also a contingent beneficiary(in case the primary beneficiary is deceased).

If a beneficiary is not appointed, if he is deceased or unable to work, the court can decide the future of your assets. Beneficiaries must be above 21 years of age and mentally capable of executing their tasks.

A letter of Intent

The purpose of a letter of intent is to lay out your wishes regarding how your assets must be treated after your incapacitation or demise. They also may contain funeral details and other specific requests. Typically, this document remains in the custody of a legal executor or beneficiary.

A letter of intent is not a valid legal document, but it does act as a back up to inform the judge of your intentions regarding the distribution of the assets if the will becomes invalid for any reason.

POA for Healthcare

A power of attorney for healthcare is an agent who you appoint to designate another individual who could be a family member or friend who can take critical health decisions in the situation you become unable to do so.

The healthcare POA you choose must be a trusted person who adheres to your course of action and shares the same views. As a precaution, it makes sense to designate a backup healthcare POA as well.

Designated Guardian

Designating an individual as a guardian is very important especially if you have minor kids or planning to have kids. This clause is normally included in a will but sometimes omitted as well. Generally, the guardian will be a family member or a close friend who is dependable, capable of raising children, share your views and financially sound. A backup guardian must be designated as well in case your first choice is incapacitated for some reason.

Estate planning does not just involve only dividing up the assets. It must include providing for your loved ones after your time and ensuring that the right individuals have access to your property. This can only happen if all the essential documents are systematically prepared with the help of an attorney.