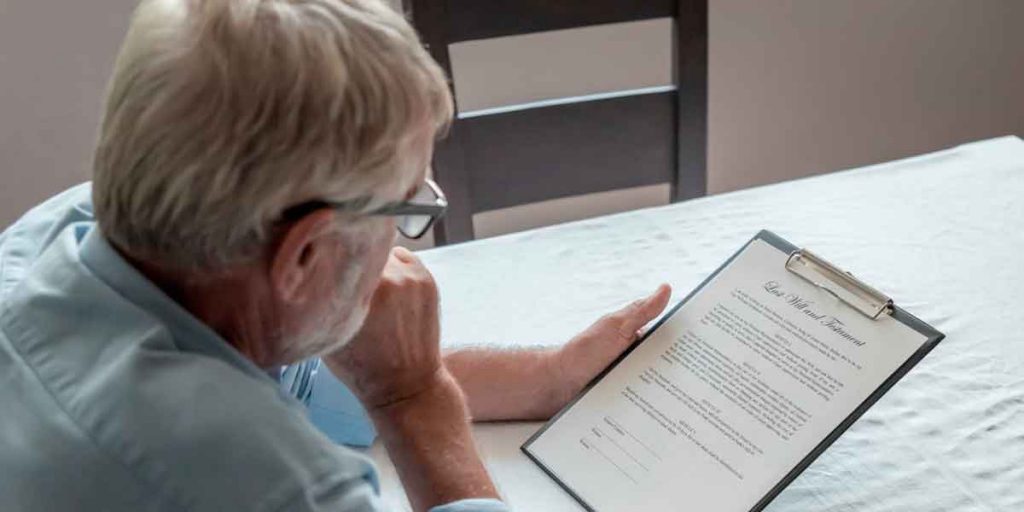

A will is one of the most important documents in estate planning. An estate plan without a will is incomplete! For an estate plan to be deemed an estate plan, there has to be a will, at least.

A will is a document that contains the wishes of the estate owner. This document usually contains the names of all estate beneficiaries, the deceased assets, the name of the estate executor, including other important information regarding the estate of the deceased. After the death of the estate owner, the estate executor is to submit the will to the probate court to begin the probate process.

In the event that the deceased failed to draft a will, the estate of the deceased will be shared based on the intestate laws of Buffalo, NY. If you need to draft your will, don’t hesitate to contact an estate planning lawyer Long Island.

Importance of a will

A will is widely regarded as one of the most important estate planning documents. Without a will, the court wouldn’t know how to share your assets. In that case, your assets will be shared based on the intestate laws of Buffalo, NY.

These days, creating a will is not difficult. With the aid of an online tool, you can easily draft a will. However, I wouldn’t advice that you draft a will using these tools especially if your estate is quite complicated. Rather, contact a competent estate planning lawyer Buffalo, NY.

A competent estate planning attorney will help you plan your estate exactly the way you want it. And if you need advice, this professional would provide you with the advice you need to create an estate plan that would make you sleep well at night.

What is Probate?

If you have no idea of what probate is, here is your chance to. Probate is a very common process which usually begins after the death of an estate owner. This court-supervised process is done to authenticate a last will and testament of a deceased, provided he or she made one.

The probate process includes locating and determining the value of the individual’s assets, settling their final bills and taxes, and sharing the rest of the estate to the designated beneficiaries.

Today, you find most estate owners planning an estate that avoids the probate process due to its complicated nature. Most times, these estate owners set up trust to bypass the process. However, some people opine that a will can prevent an estate from undergoing probate.

Does a will keep an estate from undergoing probate?

Creating a will wouldn’t stop your estate from undergoing probate. What is the essence of probate in the first place? To determine the validity of a will, right? So, it doesn’t really make sense to assume that a will can keep an estate out of probate as one of purposes of probate is to determine the authenticity of a will.

Creating a will only ensures that your assets are distributed based on your wishes. If you want to escape probate then you will have to set up a trust, hold your property jointly, or name beneficiaries in your retirement or bank account.

Let us take a look at one of the most common ways to escape probate.

How to escape probate

Setting up a living trust is no doubt one of the most common ways to escape probate. A living trust is simply an alternative to a last will. Unlike a will, which hold information regarding how you want your assets to be shared, a living trust places your assets and property “in trust” which are managed by a trustee on behalf of your beneficiaries.

Do you want to create trust to ensure that your estate escapes probate? Contact our office. Our experienced estate planning attorney can help you set up a trust for that purpose.