All debts owned by the decedent, including those on their credit cards, will be settled from their estate purse. Therefore, family members do not have to settle the debt of their loved one from their own purse.

If the money in the estate is not enough to settle all the debts, then the creditors would have to forgo their money, or take only a part of it that the estate can squeeze out.

In summary, by the Federal Trade Commission, surviving family members are not mandated to settle the debts of their deceased loved one with their own money. However, there are exceptions.

Exceptions where credit card debts may pass on to heirs

There are some situations where you may have to pay off the debts of your deceased love one. But you have to know that these circumstances are not generic situations. They are as follows:

- You own a joint credit card account with the decedent. As long as you are a co-owner of the credit card, part or all of the debt will legally pass on to you.

- You live in a community property state and you are the spouse. In community property states (Arizona, Nevada, Oklahoma, New Mexico, Alaska, Wisconsin, Texas, Idaho, Louisiana, California, and the District of Columbia), debts can fall to the surviving spouse only if he or she was a joint tenant with the deceased spouse.

- State law requires you to pay the debt. Some debts such as healthcare expenses are paid for with a credit card, and the state law may require the spouse to pay the debt.

- You administered the estate but failed to settle all the debts from the estate.

It is worth stating that authorized card users are typically not responsible for paying off credit card debt of their deceased loved one. That is because they are only authorized to use the card, but there is no formal agreement mandating them to pay the outstanding debts.

What executors need to do about debts during probate

Everything with a monetary value owned by a person at the time of their death is called their estate. This also includes all the debts they owe.

Once probate commences, the executor has the responsibility of notifying all concerned parties of the estate, which includes creditors. Therefore, the executor must notify the particular credit card companies if the deceased has credit cards with debts on them. The executor must then settle All debts, taxes, bills, and any other financial obligation of the deceased using the estate funds. Lenders are not entitled to accumulated interest while probate is going on. Interest stops counting at death.

However if the estate funds is insufficient to settle all the debts, the creditors would have to let it go, or accept the little that can be squeezed out. All in all, they cannot drag the heirs for their money. The law makes it clear.

However, some debts such as mortgages are secured using credit life insurance. With a credit life insurance, the outstanding debt will be paid to the lender by the insurance company. But if there is no insurance, then payment may not be possible if the estate cannot handle the funds.

How credit life insurance works

Credit life insurance is often sold to you when you purchase a mortgage or take some other loan. Now, there is a possibility that you may pass away before paying off your mortgage or loan. If you have a co-signer in the loan, most likely your spouse, then it would fall to them to pay off your debt. But it would be difficult for them if they are not so financially buoyant, especially when you were the breadwinner while you were alive. So this credit life insurance helps to protect your loved one from having to settle your debts with their own limited finance.

Credit life insurance protects your lender by the fact that they will still get paid in full even when you pass away.

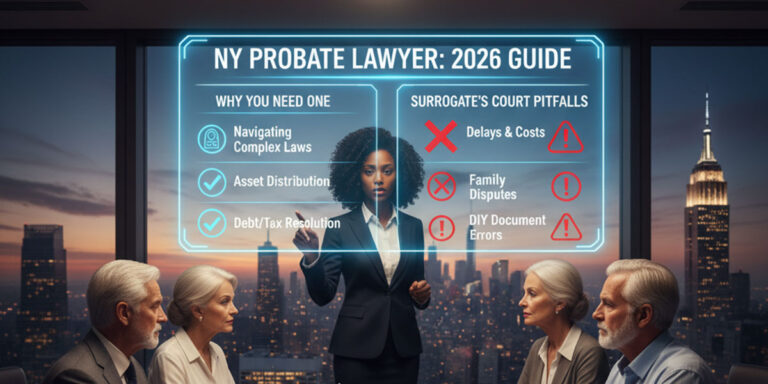

Looking towards probating an estate in New York? Speak with an experienced probate attorney

To get a seamless probate that concludes as fast as possible in New York, get help from an experienced New York probate lawyer near you.