Fair Doesn’t Mean Equal in Estate Planning in New York

When it comes to estate planning, many people assume that fairness equates to an equal distribution of assets among their heirs. However, fairness in estate

Home » Estate Planning » Wills and Trusts » Trusts » Page 8

When it comes to estate planning, many people assume that fairness equates to an equal distribution of assets among their heirs. However, fairness in estate

Estate Planning: 12 Things to Do Before You Die in New York Estate planning is a crucial step in securing the future of your loved

Providing Personalized Estate Planning Services to Protect Your Loved Ones Estate planning is a crucial process that ensures your assets are distributed according to your

Common Probate Issues Probate is a legal process that occurs after an individual passes away, involving the distribution of their assets according to their will,

Estate Planning Tips in New York Estate planning is a vital process for ensuring that your assets are protected, your healthcare decisions are respected, and

Estate Planning for the Young, Rich, and Childless in New York When it comes to estate planning, many people believe it’s something to consider later

Guardianship Attorney in NYC In New York City, the need for guardianship arises when an individual can no longer make decisions for themselves due to

Estate Planning for Blended Families Estate planning for blended families can be complex due to the unique dynamics and relationships involved. Blended families, which may

6 Essential Estate Planning Steps For You And Your Parents in New York Estate planning is one of the most important tasks you and your

Five Things to Know About Not Having an Estate Plan Many individuals often overlook estate planning, especially when life gets busy. However, not having an

Estate Planning You Must Do Before Traveling Traveling is an exciting and enriching experience, but it also comes with risks that many people overlook. Whether

Understanding the Importance of a Legal Will in New York When it comes to estate planning, creating a legal will is one of the most

Probate can be a lengthy and expensive process for heirs after the death of a loved one. As a result, many individuals seek to avoid

Five Reasons You Need an Estate Planning Attorney Near You in New York Estate planning is crucial in ensuring that your assets are distributed according

Why You Need a Probate Attorney Dealing with the estate of a deceased loved one can be challenging, especially when it involves complex legal processes

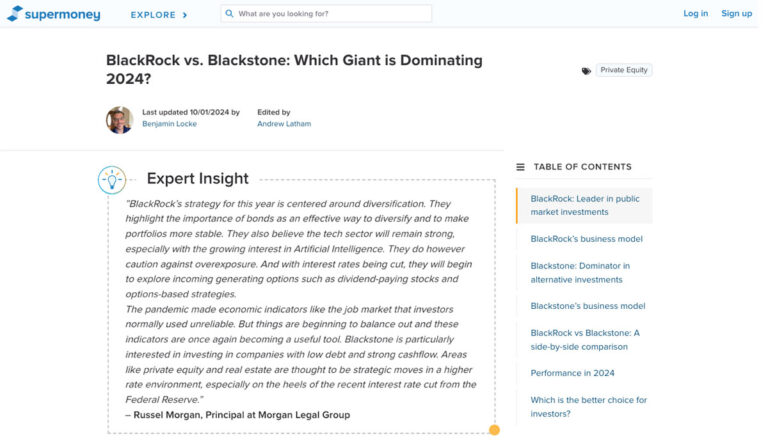

Exploring the Strengths and Dominance of BlackRock and Blackstone in 2024 BlackRock and Blackstone are two of the most powerful financial institutions in the world,

Understanding the Growing Threat of Financial Scams Targeting Retirees Financial scams targeting older Americans have become a growing issue, with a significant rise in the

Seven Reasons You Should Hire an Estate Planning Attorney in New York Estate planning is essential in securing your future and ensuring that your loved

Introducing Russel Morgan and His Mission for Justice At Morgan Legal Group, located in the heart of New York City, we specialize in estate planning,

What are the Main Ways to Pay for Long-Term Care in New York? Long-term care is a critical concern for many individuals as they age,

As we age, navigating the complexities of legal and financial planning becomes increasingly crucial. In New York, elder law attorneys are specifically trained to address

When planning for long-term care, many individuals consider Medicaid as a means to cover the often staggering costs of nursing homes and other healthcare services.

Russell Morgan Explains How Arbitration Rulings May Influence Future Settlements A former Twitter employee has won a significant legal battle over unpaid severance, a decision

Reasons Why You Need an Estate Planning Attorney in New York Regarding securing your legacy and protecting your family’s future, estate planning is an essential

Who is an Elder Law Attorney, and What Can They Do for You in New York? As we age, the legal issues we face become

Understanding the Totten Trust in New York In the complex world of estate planning, the Totten Trust often stands out as a unique and straightforward

Best Probate Attorney Near Me 10027 NYC When dealing with the death of a loved one, the last thing you want to worry about is

Understanding Estate Planning in NYC Estate planning is a critical process that involves organizing your assets and making arrangements for how they will be managed

Your Estate Plan After Divorce in New York Divorce is a significant life event that brings about many changes, both emotionally and legally. Your estate

Reasons Why You Need a Probate Attorney Probate is the legal process that occurs after someone passes away. It involves the distribution of their estate

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap