Estate Planning Lawyer near Queens

In the bustling heart of New York, particularly here in Queens, planning for the future is not just about financial security; it’s about securing your

Home » Estate Planning » Page 2

In the bustling heart of New York, particularly here in Queens, planning for the future is not just about financial security; it’s about securing your

Living in New York City requires significant financial foresight. Real estate values are astronomical. State taxes are aggressive. Consequently, protecting your wealth here is not

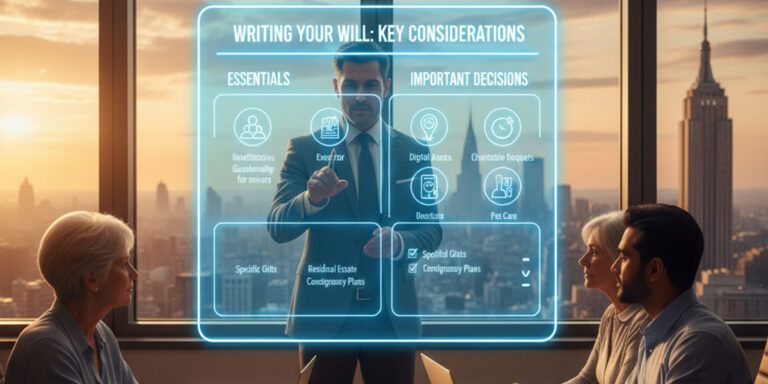

The decision to sit down and write a Will is a profound milestone. It marks a shift from building your life to actively protecting your

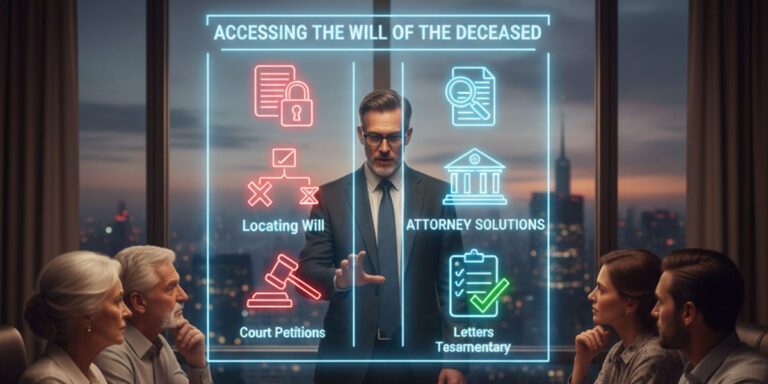

The loss of a parent brings immense emotional pain. Unfortunately, for many adult children, that grief is quickly followed by financial panic. While sorting through

The loss of a parent is an emotionally devastating event. Unfortunately, for many residents of New York State, this grief is often followed by a

There is a harsh mathematical reality facing wealthy families in New York. If you are highly successful, the government will inevitably step in to claim

The probate process is rarely the smooth, seamless transition that families envision. When a loved one passes away, you expect to file a few papers,

The days following the death of a loved one are emotionally exhausting. The last thing you want to face is a legal brick wall. Yet,

The days following the loss of a loved one are filled with grief, confusion, and overwhelming administrative tasks. Among the most stressful challenges is the

Losing a parent is one of the most profoundly difficult experiences in life. Amidst the grief and the shock, you are suddenly thrust into a