Estate planning in the digital age

Estate Planning in the Digital Age Introduction The digital age has transformed nearly every aspect of our lives, including estate planning. As online platforms and

Home » Blog

Estate Planning in the Digital Age Introduction The digital age has transformed nearly every aspect of our lives, including estate planning. As online platforms and

Analyzing the Potential Impact of Kennedy’s Healthcare Policies on Medicare Introduction Kennedy’s appointment to a pivotal role in shaping U.S. healthcare policy has sparked widespread

Essential Tips to Avoid Mistakes When Estate Planning in New York Introduction Estate planning is vital in securing your legacy and ensuring your loved ones

Assets That Can and Cannot Go Into Revocable Trusts Introduction to Revocable Trusts Revocable trusts are a cornerstone of estate planning in New York, offering

Trusts for Minor Children in New York Understanding the Importance of Trusts for Minor Children Establishing a trust for minor children is a vital component

Creating a Legal Will in Long Island Why a Legal Will is Essential A legal will is a cornerstone of estate planning, ensuring that your

How Lawyers Can Assist You Through Probate in New York The probate process can be complex and emotionally taxing, especially for families grieving the loss

Five Common Mistakes a Probate Lawyer Could Make in New York Probate is a vital process for administering an estate after someone’s death. However, even

New Parents? Estate Planning Tips to Consider Becoming a parent is a significant milestone that brings joy and responsibility. One crucial aspect that new parents

Reasons to Hire a Probate Lawyer in New York Probate is the legal process of validating a will and administering an estate after someone’s death.

5 Ways to Hiring a Probate Lawyer in New York Probate is an intricate legal process involving the validation of wills, settlement of debts, and

3 Ways to Avoid Probate in New York 2024 Probate is a legal process that oversees the distribution of a deceased person’s assets. While it

Types of Wills and New York Estate Law Estate planning is a critical aspect of ensuring your assets are distributed according to your wishes. At

The Top 10 Myths About Estate Planning in New York Estate planning is an essential process that ensures your assets are managed and distributed according

Time for You to Update Your Living Trust: 2024-2025 A living trust is one of the most versatile and powerful tools in estate planning. It

Debunking Misinformed Myths About Estate Planning in New York Estate planning is an essential process that ensures your assets, healthcare decisions, and personal wishes are

Avoiding Estate Planning Mistakes Estate planning is an essential process that ensures your assets are distributed according to your wishes, minimizes legal complications for your

Estate Planning as a DIY Challenge in New York Estate planning is often perceived as daunting, but the rise of online resources and templates has

Estate Planning for Singles: Why It Matters in New York Living a bachelor’s life in New York offers unmatched freedom and independence. However, that independence

Understanding Estate Planning for Peace of Mind in New York Planning for the future may not always be the first thing on your mind, but

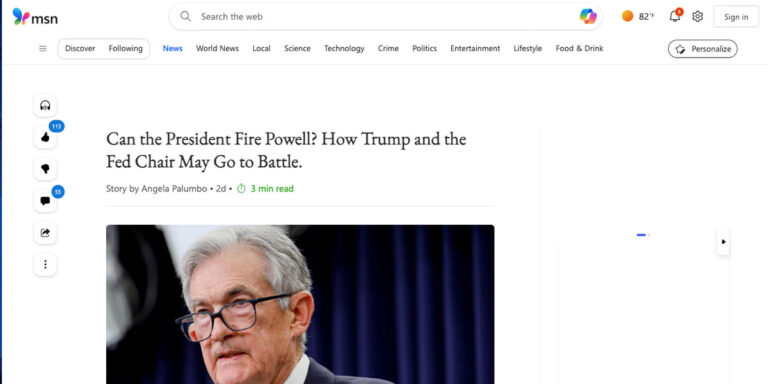

Understanding Presidential Powers Over the Federal Reserve With growing discussions around the President’s influence over the Federal Reserve, the question of whether a sitting president

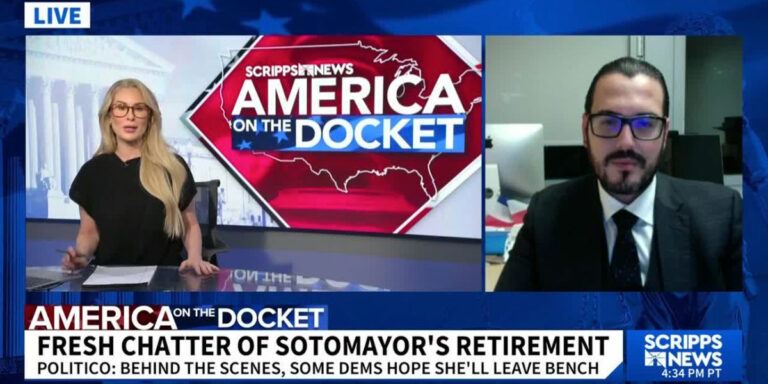

Insights from Russell Morgan on the Supreme Court’s Future Amid Political Pressures Joining us today is Russell Morgan, founder and partner of Morgan Legal Group,

Who is a Probate Lawyer in New York, and Why Do You Need One? When a loved one passes away, their estate must be managed

Russell Morgan Shares Insights on Key Legal Issues Following Recent Elections Several significant races remain undecided in light of the recent elections, leaving the nation

Understanding Probate in New York Probate is a legal process that manages the distribution of a person’s estate after their passing. In New York, the

Cancel Culture: Legal Insight on Rosanna Pansino’s FBI Report Against MrBeast In the rapidly evolving social media landscape, allegations and accusations can surface quickly, often

Cancel Culture: Understanding the FTC’s “Click to Cancel” Rule and What’s at Stake On October 16, the Federal Trade Commission (FTC) introduced a significant new

2024 US Elections: Impact on Estate Planning in New York As the 2024 US elections approach, significant policy shifts that may directly affect estate planning

Understanding Elder Law in New York 2024 As individuals age, their legal needs evolve, requiring specialized expertise in areas affecting their health, assets, and legacy.

Estate Planning Mistakes and Misconceptions in New York Estate planning is essential for protecting your assets, family, and legacy. However, many individuals in New York

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap