After President-Elect Joe Biden’s Electoral College victory over President Donald Trump, the nation’s eyes were largely focused on the two US Senate run-off elections in Georgia, which determined the makeup of the US Senate for the coming years and, with that, affected the likelihood of the enactment of President-Elect Biden’s tax agenda and other initiatives. Now that Democrat candidates Jon Ossoff and Raphael Warnock have won their respective elections, the Senate is divided 50-50, with any potential tie-breaking vote resting in the hands of Vice President-Elect Kamala Harris. As a result of these elections, many are left wondering how President-Elect Biden procedurally will go about enacting his various tax proposals and intentions. While the Biden Plan is comprehensive and contains proposals for individual income tax, taxes related to real property, and corporate tax reform, this advisory is limited to the potential estate, gift and generation-skipping transfer (GST) tax reforms that President-Elect Biden has discussed.

Overview of President-Elect Joe Biden’s Estate

President-Elect Biden has expressed an intention to decrease an individual’s federal estate tax exemption amount either to $5 million per individual, perhaps indexed for inflation and perhaps not, or to the pre-Tax Cuts and Jobs Act amount of $3.5 million per individual. This decrease in lifetime exemption could be coupled with an increased top tax rate of 45 percent. Additionally, although Biden does not support a “wealth tax,” and there has been no discussion of including a “wealth tax” in the Biden Plan, the Biden Plan might repeal stepped-up basis on death and, moreover, might tax unrealized capital gains at death at the proposed increased capital gains tax rates. While anything is possible, it should be noted that although transfer tax rates have gone up and down, transfer tax exemption amounts have never decreased before and prior attempts to repeal stepped-up basis on death have not been successful.

Likelihood of Enactment of the Biden Plan

1. Congressional Procedures

With the Democrats capturing Georgia’s two seats in the US Senate in run-off elections, they will control both chambers of Congress, including their tax-writing committees. While this should give President-Elect Biden an easier path to pass much of his tax agenda, there are certain additional Congressional procedures that need to be considered before that happens. In the Senate, subject to limited exceptions, it typically takes 60 votes to avoid a filibuster. Although Democrats “control” the Senate, they hold only 50 seats. Barring filibuster repeal, the support of at least some Republican Senators will be needed to achieve the 60 votes required to avoid a filibuster and allow tax reform legislation to proceed. That being said, there is also a process referred to as “budget reconciliation” by which some types of legistation can be moved forward in the Senate with a simple majority vote.

2. Retroactivity

Assuming that some version of the Biden Plan is passed into law, one needs to consider its effective date. Typically, tax legislation is prospective, and might not be effective until January 1, 2022 or later. Sometimes, tax legislation is retroactive, in which case it would either be effective as of its date of introduction or possibly even effective as of January 1, 2021. Although many high-net-worth individuals are contemplating additional planning in 2021 to use more or all of their remaining estate, gift and GST tax exemptions before a potential reduction in those exemption amounts, one reason to proceed with some amount of caution is the possibility that any changes to these tax regimes may be retroactive to January 1, 2021.

3. Counteracting Buyer’s Remorse

If reductions to the gift, estate and GST exemption amounts are made retroactive to January 1, 2021, is there anything that can be done for individuals who made gifts in 2021 prior to the enactment of these changes in law? Individuals contemplating such gifts should speak with an experienced estate planning professional to discuss certain techniques that can be considered to unwind estate planning in order to avoid an unintended gift or GST tax. For example, the individual could consider disclaimer planning, including allowing one beneficiary of a trust to disclaim on behalf of all trust beneficiaries.

What Estate Planning Opportunities Are Expected In 2021

While we are likely to see these changes sometime in the next two years, many believe that it will not occur during the calendar year 2021. Congress has other items that it has prioritized. Therefore, 2021 may provide a unique opportunity to plan to avoid these increased taxes.

There is little that can be done to avoid paying higher income taxes or capital gains taxes right now. However, there is a huge opportunity to avoid paying more in estate taxes. As I previously mentioned, any change to the estate/gift tax exemption is unlikely to be retroactive. This means it will only apply to gifts made after it is passed. We also know from IRS guidance that you will not have to pay estate or gift tax if you use the increased exemption, and Congress later lowers the exemption. Therefore, for many of my clients now is time they are looking to gift land, business interests, and other discretionary assets. Making a gift now can save you a lot in potential future estate taxes!

Likely Tax Changes

There are likely to be changes to the ordinary income tax regime, estate tax regime, and capital gains tax regime sometime while Democrats are in control of Congress and the White House.

First, we are likely to see an increase in the top marginal income tax rate. Currently, the top marginal income tax bracket is 37 percent. This rate was lowered as part of the 2017 Trump Tax Cuts. With the Democrats in control, we will likely see an increase in the top marginal tax rate to 39.6 percent.

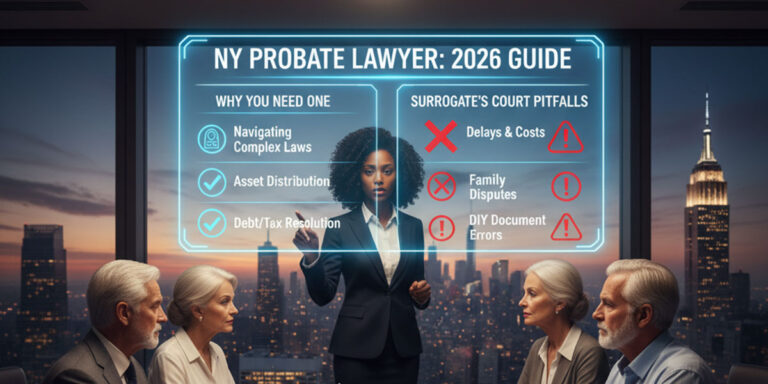

Get help

If you would like to learn more about estate planning, any one of our estate planning attorneys would be happy to assist you.