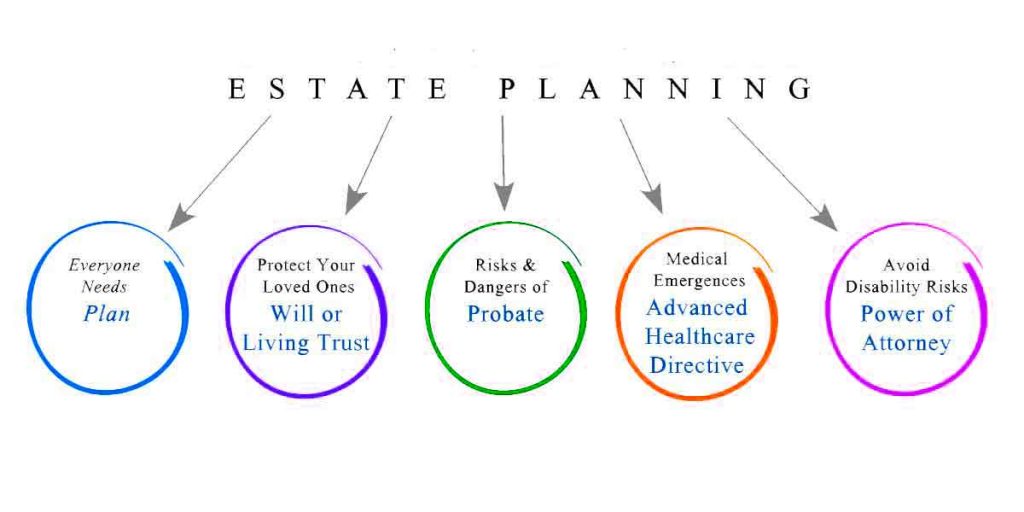

Estate planning is a significant move taken to ensure that your wishes are fulfilled and your loved ones are well catered for after your death. Aside from ensuring that your assets are shared according to your wish, an estate plan can also reduce the amount of estate tax to be paid before your assets are distributed to the designated beneficiaries, help settle the cost associated with the probate process, dictate how you wish to be buried, set forth the type of medical care you desire in case you become incapacitated.

- Not making estate plans at all

Without a will, your estate will go through the probate process. This is very expensive and lengthy, and the estate will be distributed according to New York laws. Therefore your children may not be receiving what you originally would have wanted for them. This means that you have no say, and the court will decide what happens to your estate. Due to the lengthy process, your family may be left with no funds to cater to their needs until the process concludes and they receive their inheritance.

- Not planning for estate tax

The estate tax exemption amount for New York is $5.85 million. If your estate exceeds this value, a value up to 16% will go to the state as tax before your beneficiaries can inherit the rest. This is a huge amount, money better off given to your loved one. Not planning for tax means you will not be getting the most of your estate. Estate planning lawyers in New Jersey are proficient in tax planning, and through certain legal strategies, can help you get the most out of your estate.

- Not making enough consideration for your family

In as much as you want to provide for your family through estate planning, it is possible that you do not give them sufficient consideration. Look at it this way. You may have a lot of money and so giving this, or that amount to John or Doe will not be difficult for you. However, while doing this, you may forget to consider who deserves what asset most and who deserves more funds. You may end up giving too many funds to the wrong person who may likely lose it—such as a gambler or problem child—while leaving fewer funds to someone that needs more.

- Forgetting to fund (activate) your trust

You’ve created a trust. Great! However, that’s not all. In fact, your trust is empty, inactive, and powerless until an asset is funded into it. Many people make the mistake of creating a trust without funding it, thinking that its creation alone will make all their assets pass outside probate. Only assets that are funded into the trust will pass outside probate.

- Choosing the wrong person as your fiduciary

Another common mistake people make while estate planning is choosing the wrong executor, trustee, or guardian. There are legal requirements for these positions. For example, only a New York resident can execute a New York will. So if you appoint that friend of yours in North Carolina to execute your will in New Jersey, they will not be allowed to.

You may also make the mistake of choosing someone because they’re a close family member, forgetting that they may not be competent or trustworthy enough to handle your trust, estate administration, or guardianship for your minors. When you choose the wrong person, your estate will suffer and consequently your loved ones.

Speak with an estate planning lawyer

It is wrong to believe you can always handle estate planning all by yourself, especially when you have little or no knowledge of estate laws applicable in this city. To ensure you get everything right, kindly contact and hire an experienced estate planning attorney.

Why should you hire an estate planning attorney?

Estate planning is a tedious and technical process best suited for an estate planning attorney. Nobody except maybe a probate attorney wants to go through the difficult process of probate which is done to check the authenticity of a will. A professional estate planning attorney will help you create which is the best and advisable way to avoid probate, additionally peradventure your estate is bound to undergo probate, the estate planning attorney can and will help you and your loved ones prepare.

Contact us

Talk to our experienced estate planning attorney in New Jersey. Embark on a smooth estate planning journey today, and be sure to get quality and a hundred percent professional assistance.