Advantages of Establishing Revocable Living Trusts in New York: A Comprehensive Guide

As seasoned estate planning attorneys at Morgan Legal Group, we understand that planning for your future, and for your loved ones requires a thoughtful and strategic approach. Specifically, for many New York residents, revocable living trusts have become an essential element of any effective plan, offering a variety of benefits that extend beyond traditional wills. Therefore, this article provides an in-depth exploration of the advantages of establishing a revocable living trust, with a particular focus on how these trusts can help you avoid probate, maintain privacy, and have a greater level of flexibility in your estate management, all in compliance with New York State laws and guidelines. Indeed, creating a living trust can be a useful and effective way to ensure that your legacy is secure.

Understanding Revocable Living Trusts

Before delving into the specific advantages, it’s crucial to define what a revocable living trust is and how it operates. Primarily, a revocable living trust, is a legal arrangement you create during your lifetime to hold and manage your assets for your benefit. Specifically, it is often referred to as a “living” trust, as it is created while you are still living, and allows you to retain control over your assets while also specifying how they should be managed upon your passing, or if you become incapacitated. Thus, this is a powerful tool for those seeking flexibility and control over their assets.

- Created During Your Lifetime: Notably, a living trust is created, and effective, during your lifetime.

- Retain Control: Also, the person who creates the trust, can maintain control of the assets during their life.

- Flexibility: Furthermore, you can modify or even revoke the trust, as your needs and goals change.

Key Elements of a Revocable Living Trust

To best understand how a revocable living trust functions, it’s helpful to understand its key elements, and all of the moving parts. Specifically, these elements include the grantor, the trustee, and the beneficiaries, and each of these roles is essential to the legal working of the document. Therefore, understanding each of these will provide a clearer picture of how this type of trust works:

- Grantor (Settlor): Primarily, the grantor is the individual creating the trust, and transferring their assets to it.

- Trustee: Also, the trustee manages the assets held in the trust.

- Beneficiary: Furthermore, the beneficiary is the person or entity who benefits from the trust.

- Successor Trustee: Finally, a successor trustee will step in after the grantor’s death, or if the grantor becomes incapacitated.

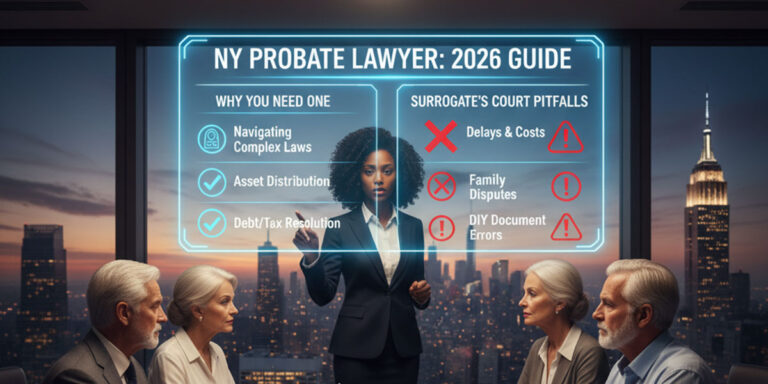

Advantage 1: Avoiding the Probate Process in New York

One of the most significant advantages of a revocable living trust is its ability to help your estate avoid the probate process. Specifically, probate is a court-supervised legal proceeding that is used to validate a will, and oversee the distribution of assets to a deceased person’s heirs, and this process can be very long, costly and public. Therefore, the primary benefit of a revocable living trust is to allow your estate to pass on to your beneficiaries without having to go through this process.

- Time Savings: Notably, avoiding probate allows for a more rapid transfer of assets.

- Cost Reduction: Additionally, the costs associated with probate are avoided.

- Reduced Complexity: Moreover, avoiding probate also allows your estate to be managed more efficiently, and with less stress for your loved ones.

The Drawbacks of Probate in New York

To better understand why avoiding probate is so beneficial, it is important to understand the drawbacks of the probate process, particularly in New York. Specifically, the process can be very time-consuming, and can take many months or even years to complete. Therefore, avoiding this process can provide significant benefits, as a result:

- Lengthy Process: First and foremost, probate can often be a lengthy process, that may take many months, or years.

- Costly Legal Fees: Secondly, probate can often involve high legal and administrative fees, that will impact your estate.

- Public Record: Thirdly, probate proceedings become part of the public record, and thus can be viewed by anyone.

Advantage 2: Maintaining Privacy in Estate Matters

Another crucial advantage of revocable living trusts is their ability to maintain the privacy of your estate matters. Specifically, because a living trust avoids the probate process, its terms, your asset values, and your beneficiary designations are not a matter of public record, as they would be, if your estate went through probate. Therefore, privacy and confidentiality are greatly enhanced, for all of your estate assets, and for your loved ones.

- Confidentiality: Primarily, the details of your trust remain private and are not open to public scrutiny.

- Protection from Public Scrutiny: Also, your assets are not made public, as they are during probate.

- Family Security: Furthermore, maintaining privacy can help to protect your family from unwanted attention and unwanted legal challenges.

The Public Nature of Probate in New York

It is important to highlight, that any will, if it goes through probate in New York, becomes a public document, meaning that anyone can view its contents, including lists of assets, and the names of your beneficiaries. Specifically, this lack of privacy is a concern for many individuals, who would rather keep their financial affairs confidential. Therefore, a living trust can give you greater control over the privacy of your affairs, and it can also offer a greater level of control over your overall estate plan.

- Public Access to Documents: Notably, the full contents of a will that goes through probate are accessible to the public.

- Potential Security Risks: Additionally, this lack of privacy can create a security risk for family members.

- Loss of Control: Furthermore, having the details of your estate in a public forum makes it more difficult to maintain confidentiality and to have full control over the management of your assets.

Advantage 3: Providing Flexibility in Estate Management

A third major benefit of a revocable living trust is the flexibility it offers for managing your estate during your lifetime. Specifically, as the grantor, you retain full control over the assets in the trust, and you can make changes to the trust, at any time, as long as you are still living, and have the legal capacity to do so. Therefore, this element of control and adaptability is a powerful tool for meeting all of your unique needs and objectives:

- Ability to Amend: Firstly, you can change the terms of the trust at any time during your life.

- Control Over Assets: Secondly, you retain full control over all of the assets that are within the trust, during your lifetime.

- Flexibility for Life Changes: Finally, you can make changes in the trust document, in response to significant changes in your life, as needed.

Managing Assets During Incapacity

In addition to the other benefits noted, a revocable living trust can also provide a method for managing your assets if you become incapacitated or unable to manage your own financial affairs. Specifically, you can name a successor trustee, who can step in and manage the assets, according to the terms of your trust, and without any need for court intervention. Therefore, this feature offers an extra layer of protection, that is an essential element of an overall estate plan.

- Avoid Guardianship: For example, a living trust may allow you to avoid the need for a court appointed guardian, in the case of your incapacitation.

- Seamless Transition: Also, your assets can be managed without any unnecessary delay or disruption, for the benefit of your family, and also in accordance with your wishes.

- Peace of Mind: Furthermore, planning in advance can provide you with peace of mind, knowing your wishes will be honored, and that your assets will be managed correctly, if you become incapacitated.

Revocable Living Trusts and New York State Law

When establishing a living trust, it is important to remember that it must comply with all rules and requirements of New York law. Specifically, New York has its own specific laws regarding trusts and estates, which must be followed to ensure your documents are valid and fully enforceable. Therefore, you must work with a legal expert who understands New York State law, in order to create a well structured and legally valid plan.

- Compliance with State Rules: Notably, your living trust must comply with all laws and guidelines set forth by New York State.

- Proper Execution: Additionally, your trust documents must be legally executed by all parties involved, in order to be considered valid under the law.

- Expert Legal Guidance: Furthermore, a knowledgeable attorney will make sure that all state laws are followed to the letter.

The Role of a Trustee in New York

In New York, the role of the trustee is very important, and must be considered with great care. Specifically, the trustee is responsible for managing the trust’s assets according to the trust document, and for acting in the best interest of the trust’s beneficiaries. Therefore, choosing a trustee that is both responsible and trustworthy is an important part of overall estate planning:

- Management of Assets: For instance, the trustee is responsible for managing and protecting all assets held in the trust.

- Fiduciary Duty: Additionally, the trustee has a fiduciary responsibility to act in the best interest of the beneficiaries.

- Adherence to Trust Terms: Finally, the trustee must adhere to the specific rules and guidelines that are set forth in the trust document.

Comparing Revocable Trusts with Wills

While both wills and revocable living trusts are used in estate planning, they serve different functions, and have different advantages. Specifically, a will is a legal document that directs how your assets should be distributed upon your death, but it does go through the probate process, while a trust allows assets to be distributed outside of that public forum. Therefore, both methods have advantages, and should be considered carefully before making your choice:

- Probate: Firstly, wills go through probate, but living trusts typically avoid this process.

- Privacy: Secondly, wills become public documents after probate, while trusts are private.

- Flexibility: Thirdly, trusts offer flexibility during your lifetime, and can be changed more easily than a will.

Working With Morgan Legal Group

When you choose Morgan Legal Group, you are partnering with a firm that understands the intricacies of New York estate planning, and can help guide you toward making the best legal and financial decisions. Specifically, our attorneys are well-versed in all aspects of revocable living trusts, and we can help you create a personalized plan that meets all of your needs and goals. Therefore, when you work with our firm you can expect:

- Local Expertise: Firstly, our firm has deep expertise in all New York State laws and regulations related to estate planning.

- Personalized Approach: Secondly, we will craft a plan that is tailored to your unique needs and preferences.

- Proactive Planning: Thirdly, we focus on creating proactive strategies, so that your estate plan will meet your goals now and in the future.

- Compassionate Support: Finally, we approach every client with empathy and understanding for the sensitive nature of estate planning.

Common Mistakes to Avoid When Setting Up a Revocable Trust

Even with the best intentions, there are a few common errors that people often make when setting up a revocable trust, that may inadvertently jeopardize their plans. Specifically, some people make the mistake of trying to create these documents on their own, or not funding the trust correctly. Therefore, to avoid those mistakes, you must be aware of the following common errors:

- DIY Approach: Firstly, trying to create your own legal documents, without professional help.

- Improper Funding: Secondly, not properly transferring your assets to the ownership of your trust.

- Not Seeking Legal Advice: Thirdly, not working with a qualified attorney who understands all relevant state laws.

- Outdated Information: Finally, not reviewing your plan regularly to ensure it still reflects your wishes.

Steps to Take Now to Secure Your Estate

If you’re considering the advantages of a revocable living trust, it’s essential to act proactively and begin planning, as soon as possible. Specifically, putting off making these decisions may limit your ability to protect your assets and your loved ones in the future. Therefore, take these simple steps, to start the process of planning your estate:

- Schedule a Consultation: First, reach out to Morgan Legal Group for an initial consultation.

- Inventory Your Assets: Second, make a list of all of your assets, including real estate, bank accounts, and other financial holdings.

- Develop Your Plan: Third, work with our legal team to create your customized estate plan, including your revocable living trust.

For more information on estate planning you can also refer to the website of the New York State Bar Association: www.nysba.org.

Conclusion: Protecting Your Future with a Revocable Living Trust

In conclusion, establishing a revocable living trust in New York offers a number of compelling advantages for your estate, including avoiding probate, maintaining privacy, and providing a greater level of flexibility in the management of your assets. Specifically, these benefits will ensure that your legacy is passed on in accordance with your desires and that your loved ones are cared for after you have passed away. Therefore, by working with the experienced team at Morgan Legal Group, you can take the first steps toward creating a well-structured plan that protects both your assets, and your family, and that will achieve all of your long term goals. Thus, do not wait, contact us today to begin the process of securing your future.